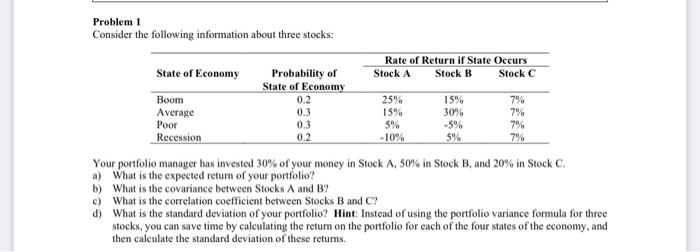

Question: Problem 1 Consider the following information about three stocks: Your portfolio manager has invested 30% of your money in Stock A, 50% in Stock B,

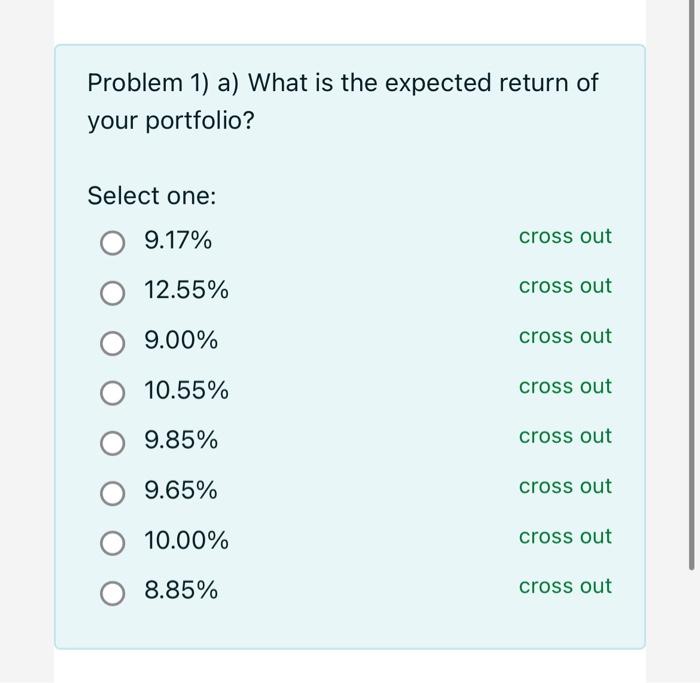

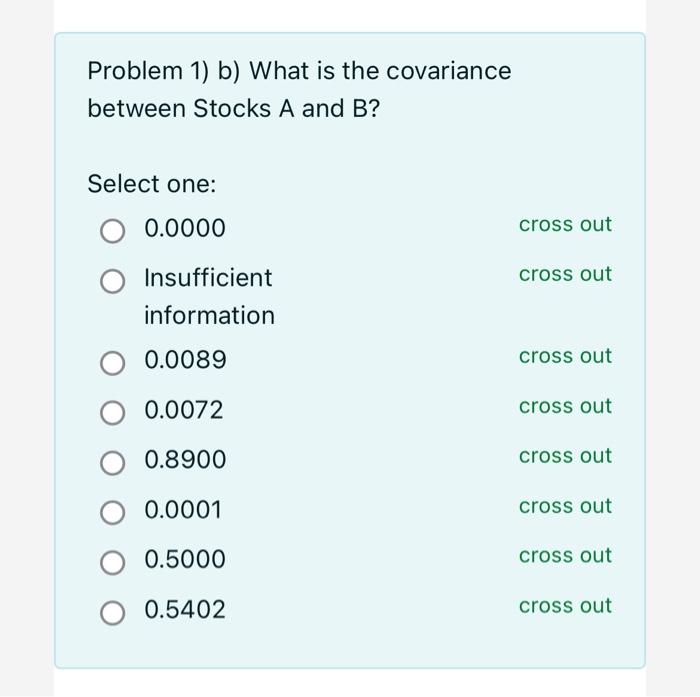

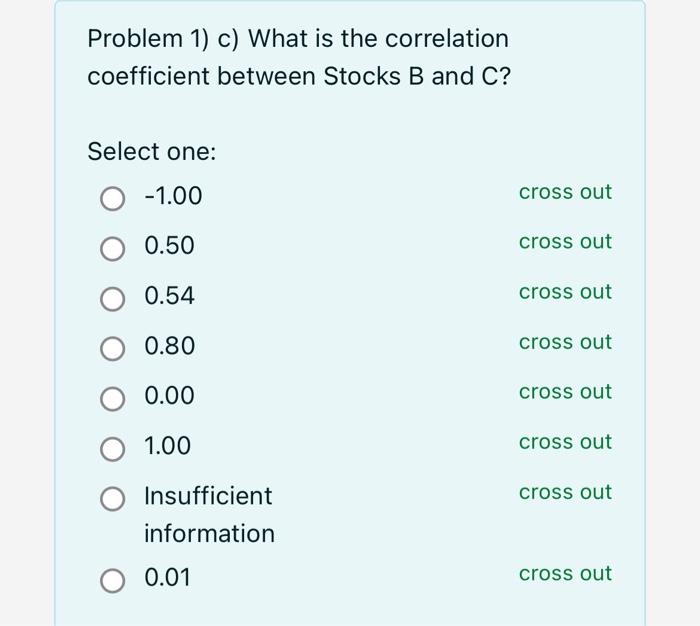

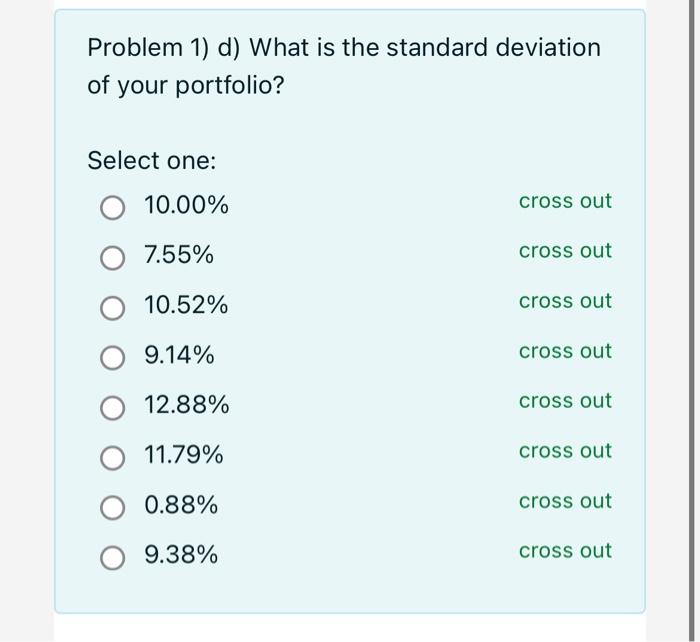

Problem 1 Consider the following information about three stocks: Your portfolio manager has invested 30% of your money in Stock A, 50% in Stock B, and 20% in Stock C. a) What is the expected return of your portfolio? b) What is the covariance between Stocks A and B? c) What is the correlation cocfficient between Stocks B and C ? d) What is the standard deviation of your portfolio? Hint: Instead of using the portfolio yariance formula for three stocks, you can save time by calculating the retum on the portfolio for each of the four states of the economy, and then calculate the standard deviation of these retums. Problem 1) a) What is the expected return of your portfolio? Select one: 9.17% cross out 12.55% cross out 9.00% cross out 10.55% cross out 9.85% cross out 9.65% cross out 10.00% cross out 8.85% cross out Problem 1) b) What is the covariance between Stocks A and B? Select one: 0.0000 cross out Insufficient information 0.0089 cross out 0.0072 cross out 0.8900 cross out 0.0001 cross out 0.5000 cross out 0.5402 cross out Problem 1) c) What is the correlation coefficient between Stocks B and C? Select one: 1.00 cross out 0.50 cross out 0.54 cross out 0.80 cross out 0.00 cross out 1.00 cross out Insufficient cross out information 0.01 cross out Problem 1) d) What is the standard deviation of your portfolio? Select one: 10.00% cross out 7.55% cross out 10.52% cross out 9.14% cross out 12.88% cross out 11.79% cross out 0.88% cross out 9.38% cross out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts