Question: Problem 1: DOZ Telecom is considering a project for the coming year that will cost P50 million. DQZ plans to use the following combination of

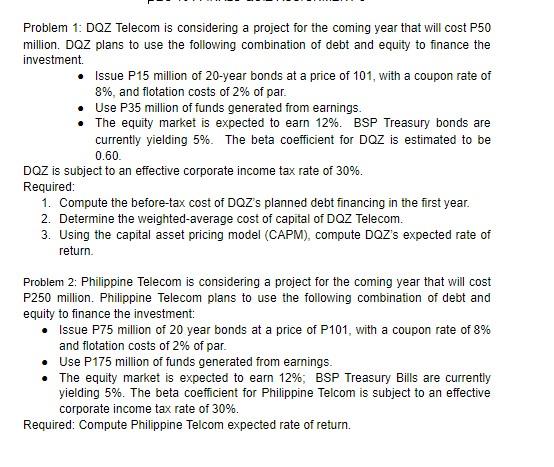

Problem 1: DOZ Telecom is considering a project for the coming year that will cost P50 million. DQZ plans to use the following combination of debt and equity to finance the investment Issue P15 million of 20-year bonds at a price of 101, with a coupon rate of 8%, and flotation costs of 2% of par. Use P35 million of funds generated from earnings. The equity market is expected to earn 12%. BSP Treasury bonds are currently yielding 5%. The beta coefficient for DAZ is estimated to be 0.60 DOZ is subject to an effective corporate income tax rate of 30%. Required: 1. Compute the before-tax cost of DOZ's planned debt financing in the first year. 2. Determine the weighted-average cost of capital of DOZ Telecom. 3. Using the capital asset pricing model (CAPM), compute DOZ's expected rate of return Problem 2: Philippine Telecom is considering a project for the coming year that will cost P250 million. Philippine Telecom plans to use the following combination of debt and equity to finance the investment: Issue P75 million of 20 year bonds at a price of P101, with a coupon rate of 8% and flotation costs of 2% of par. Use P175 million of funds generated from earnings. The equity market is expected to earn 12%, BSP Treasury Bills are currently yielding 5%. The beta coefficient for Philippine Telcom is subject to an effective corporate income tax rate of 30%, Required: Compute Philippine Telcom expected rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts