Question: Problem 1. Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up

Problem 1. Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up for $1.5 m investment.

Required ROR by investor(s): 25%

Net income in five years: $ 3.2 m

Expected P/E ratio in four years: 12 times

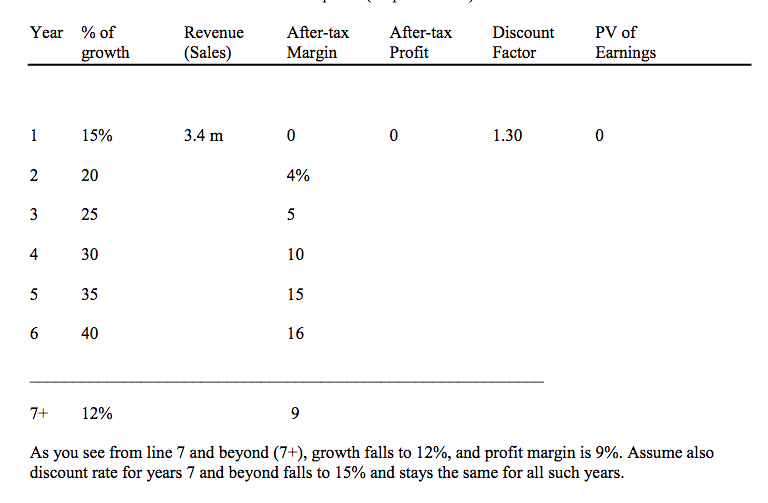

Problem 2. Part A. Apply the fundamental method of valuation to the following data in order to find a market value (price) for the venture. Part B. What portion of the company should be given up if there is a need for $1.6 m in venture capital?

Need help solving problem 1 and problem 2: Part A & B please..

Year % of Revenue After-tax After-tax Profit Discount PV of growth (Sales) Margin Factor Earnings 1.30 1 15% 3.4 m 0 0 2 20 4% 3 25 5 30 10 5 35 15 6 40 16 7+ 12% As you see from line 7 and beyond (7+), growth falls to 12%, and profit margin is 9%. Assume also discount rate for years 7 and beyond falls to 15% and stays the same for all such years. t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts