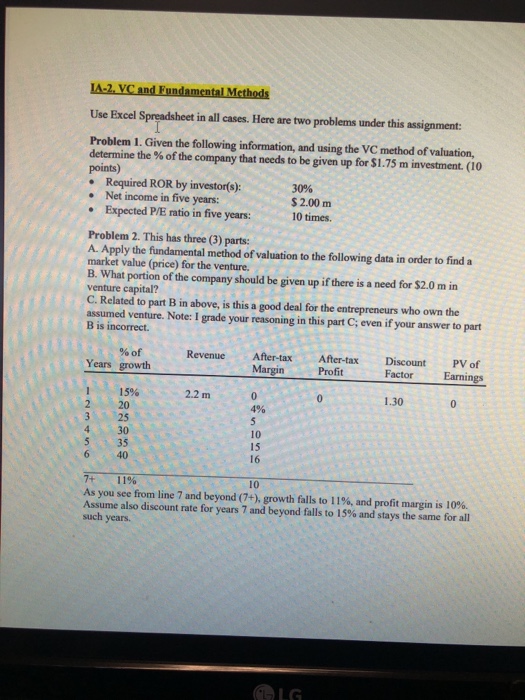

Question: IA-2, VC and Fundamental Methods Use Excel Spreadsheet in all cases. Here are two problems under this assignment: Problem 1. Given the following information, and

IA-2, VC and Fundamental Methods Use Excel Spreadsheet in all cases. Here are two problems under this assignment: Problem 1. Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up for $1.75 m investment (10 points) Required ROR by investor(s): 30% $ 2.00 m 10 times. Net income in five years: Expected P/E ratio in five years: Problem 2. This has three (3) parts: A. Apply the fundamental method of valuation to the following data in order to find a market value (price) for the venture. B. What portion of the company should be given up if there is a need for $2.0 m in venture capital? C. Related to part B in above, is this a good deal for the entrepreneurs who own the assumed venture. Note: I grade your reasoning in this part C; even if your answer to part B is incorrect. RevenueAfter-tax After-tax Discount PV of Earnings %of MarginProfit Factor 15% 2.2 m 1.30 4% 2 20 3 25 4 30 5 35 6 40 10 15 16 1196 10 As you see from line 7 and beyond (74), growth falls to l 1%, and profit margin is 10% Assume also discount rate for years 7 and beyond falls to 15% and stays the same for all such years. IA-2, VC and Fundamental Methods Use Excel Spreadsheet in all cases. Here are two problems under this assignment: Problem 1. Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up for $1.75 m investment (10 points) Required ROR by investor(s): 30% $ 2.00 m 10 times. Net income in five years: Expected P/E ratio in five years: Problem 2. This has three (3) parts: A. Apply the fundamental method of valuation to the following data in order to find a market value (price) for the venture. B. What portion of the company should be given up if there is a need for $2.0 m in venture capital? C. Related to part B in above, is this a good deal for the entrepreneurs who own the assumed venture. Note: I grade your reasoning in this part C; even if your answer to part B is incorrect. RevenueAfter-tax After-tax Discount PV of Earnings %of MarginProfit Factor 15% 2.2 m 1.30 4% 2 20 3 25 4 30 5 35 6 40 10 15 16 1196 10 As you see from line 7 and beyond (74), growth falls to l 1%, and profit margin is 10% Assume also discount rate for years 7 and beyond falls to 15% and stays the same for all such years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts