Question: Problem 1 . In your new role as a project financial analyst, you are tasked to evaluate a project named Tetra, a new and innovative

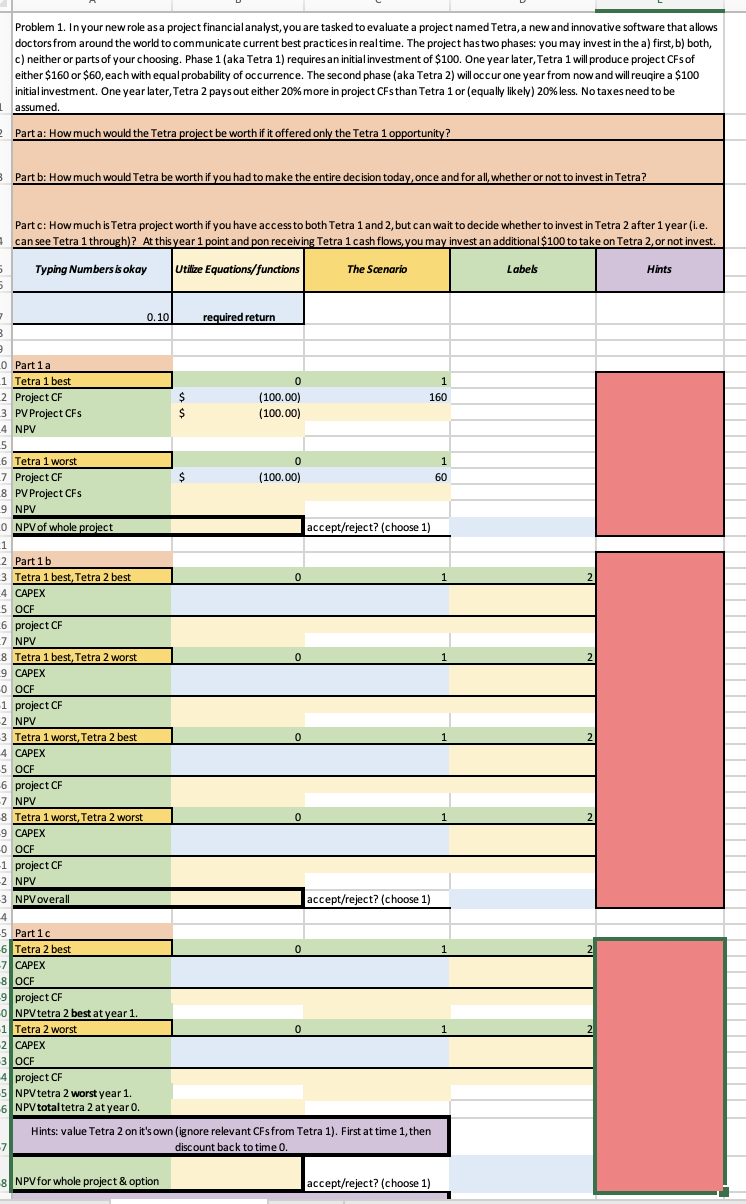

Problem In your new role as a project financial analyst, you are tasked to evaluate a project named Tetra, a new and innovative software that allows

doctors from around the world to communicate current best practices in real time. The project has two phases: you may invest in the a first, b both,

c neither or parts of your choosing. Phase aka Tetra requires an initial investment of $ One year later, Tetra will produce project CFs of

either $ or $ each with equal probability of occurrence. The second phase aka Tetra will occur one year from now and will reuqire a $

initial investment. One year later, Tetra pays out either more in project CFs than Tetra or equally likely less. No taxes need to be

assumed.

Part a: How much would the Tetra project be worth if it offered only the Tetra opportunity?

Part b: How much would Tetra be worth if you had to make the entire decision today, once and for all, whether or not to invest in Tetra?

Part c: How much is Tetra project worth if you have access to both Tetra and but can wait to decide whether to invest in Tetra after year ie

can see Tetra through At this year point and pon receiving Tetra cash flows, you may invest an additional$ to take on Tetra or not invest. Please show on Excel with formula!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock