Question: Problem 1. In your new role as a project financial analyst, you are tasked to evaluate a project named Tetra, a new and innovative software

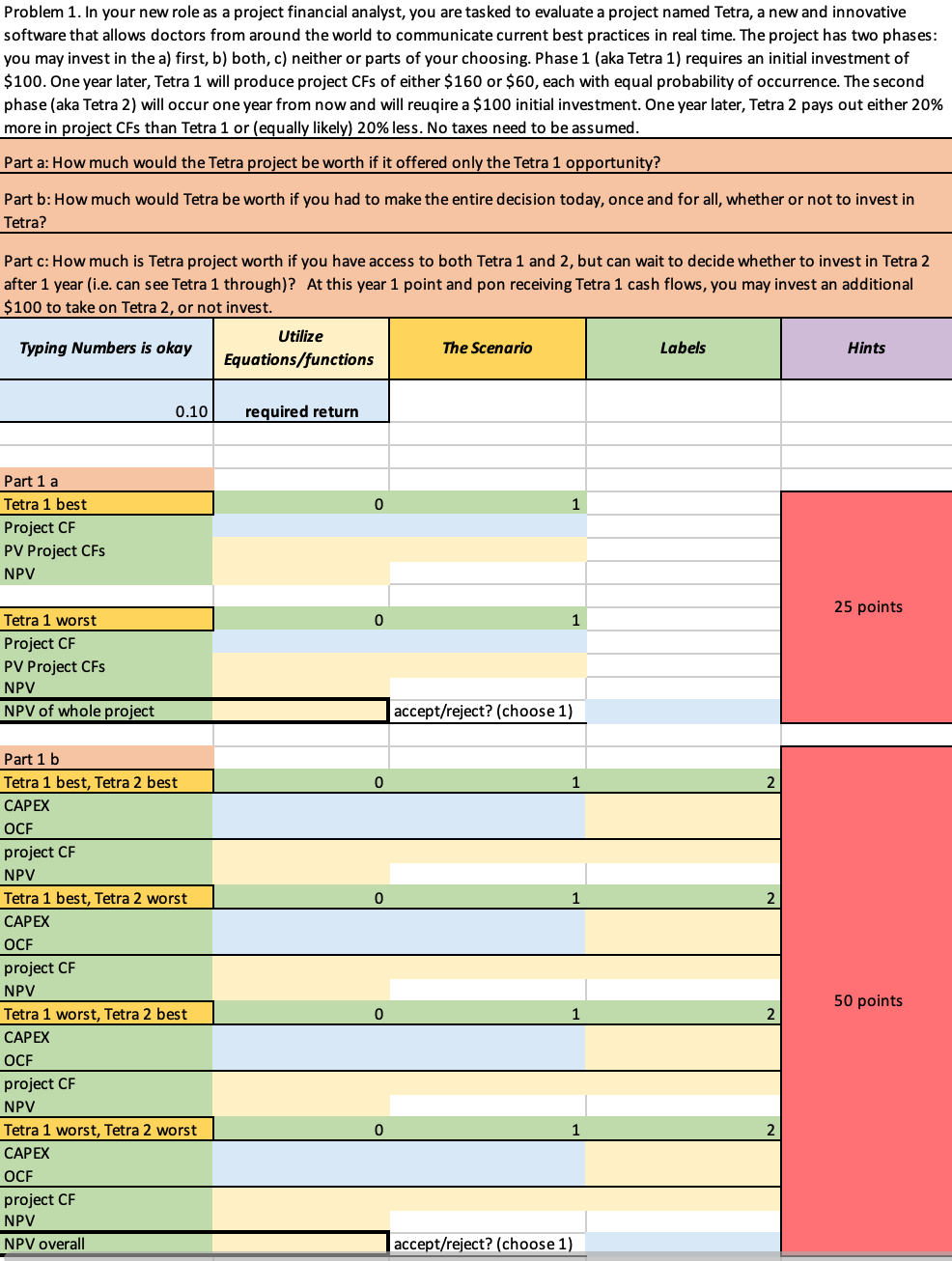

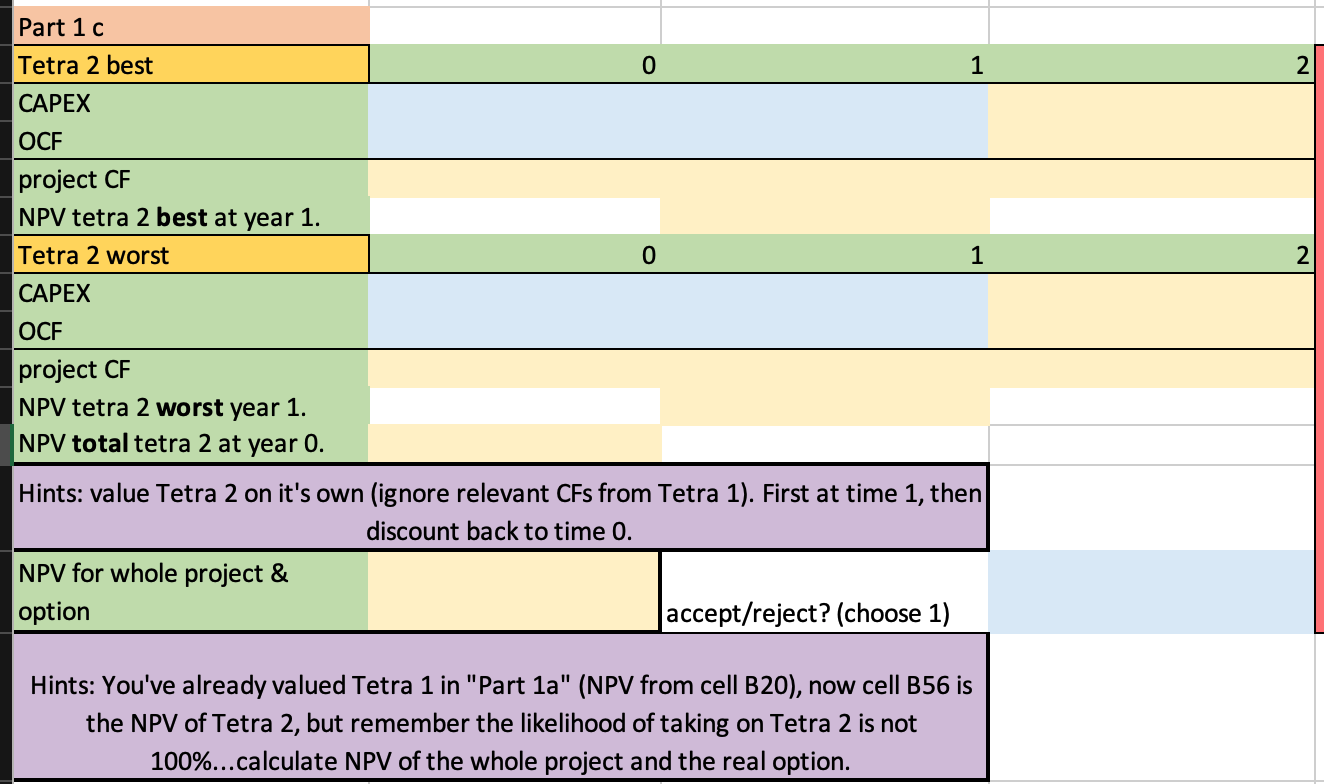

Problem 1. In your new role as a project financial analyst, you are tasked to evaluate a project named Tetra, a new and innovative software that allows doctors from around the world to communicate current best practices in real time. The project has two phases: you may invest in the a) first, b) both, c) neither or parts of your choosing. Phase 1 (aka Tetra 1) requires an initial investment of $100. One year later, Tetra 1 will produce project CFs of either $160 or $60, each with equal probability of occurrence. The second phase (aka Tetra 2) will occur one year from now and will reuqire a $100 initial investment. One year later, Tetra 2 pays out either 20% more in project CFs than Tetra 1 or (equally likely) 20% less. No taxes need to be assumed. Part 1c Tetra2bestCAPEXOCFprojectCF NPV tetra 2 best at year 1. \begin{tabular}{l} Tetra 2 worst \\ \hline CAPEX \\ OCF \\ \hline project CF \\ NPV tetra 2 worst year 1. \\ NPV total tetra 2 at year 0. \end{tabular} NPV total tetra 2 at year 0 . Hints: value Tetra 2 on it's own (ignore relevant CFs from Tetra 1). First at time 1, then discount back to time 0 . NPV for whole project \& option accept/reject? (choose 1 ) Hints: You've already valued Tetra 1 in "Part 1a" (NPV from cell B20), now cell B56 is the NPV of Tetra 2, but remember the likelihood of taking on Tetra 2 is not 100% calculate NPV of the whole project and the real option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts