Question: PROBLEM 1 Inputs Beta Dividend Outputs Required return Intrinsic value Over or under valued PROBLEM 2 Inputs Beta Div 2 0 2 0 Growth rate

PROBLEM

Inputs

Beta

Dividend

Outputs

Required return

Intrinsic value

Over or under valued

PROBLEM

Inputs

Beta

Div

Growth rate

Outputs

Div

r

IV

Over or under valued PROBLEM

Inputs

EPS

Dividend

DPO

ROE

Beta

PE

Outputs

Average DPO

Growth rate

Required return

Average PE

EPS

Dividend

Sale price

Total cash flow

NPV

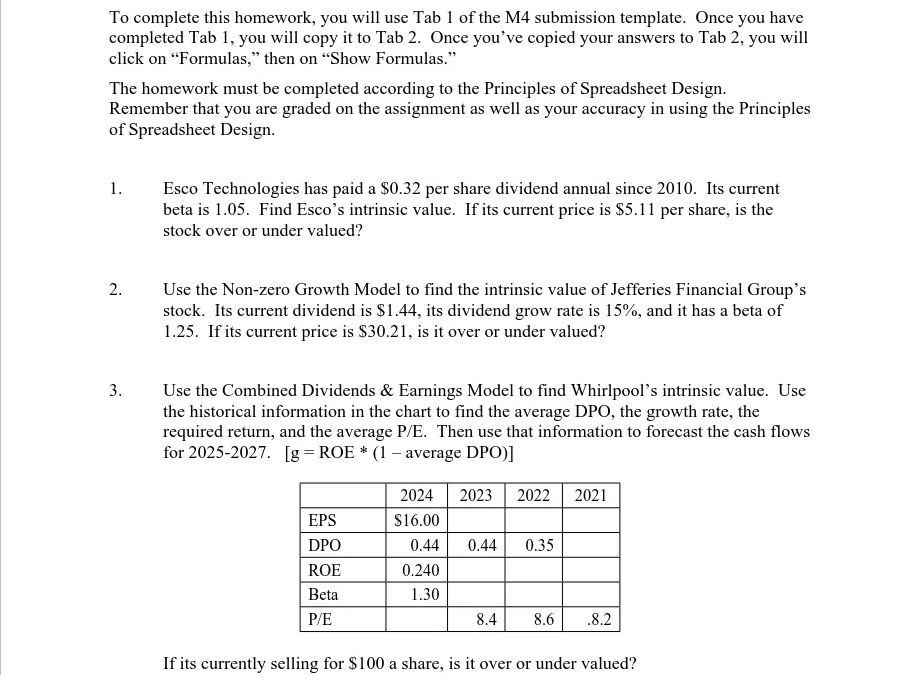

Over or under valuedTo complete this homework, you will use Tab of the M submission template. Once you have completed Tab you will copy it to Tab Once you've copied your answers to Tab you will click on "Formulas," then on "Show Formulas."

The homework must be completed according to the Principles of Spreadsheet Design.

Remember that you are graded on the assignment as well as your accuracy in using the Principles

of Spreadsheet Design.

Esco Technologies has paid a $ per share dividend annual since Its current

beta is Find Esco's intrinsic value. If its current price is $ per share, is the

stock over or under valued?

Use the Nonzero Growth Model to find the intrinsic value of Jefferies Financial Group's

stock. Its current dividend is $ its dividend grow rate is and it has a beta of

If its current price is $ is it over or under valued?

Use the Combined Dividends & Earnings Model to find Whirlpool's intrinsic value. Use

the historical information in the chart to find the average DPO, the growth rate, the

required return, and the average Then use that information to forecast the cash flows

for average DPO :

If its currently selling for $ a share, is it over or under valued?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock