Question: Problem 1 Jane Kent is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred. May 1

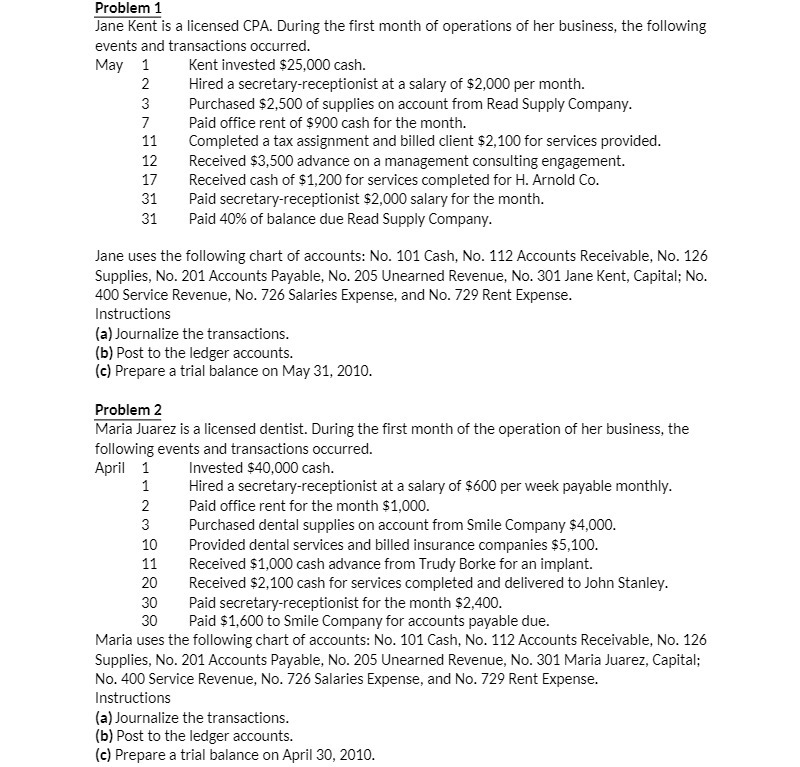

Problem 1 Jane Kent is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred. May 1 Kent invested $25,000 cash. NO Hired a secretary-receptionist at a salary of $2,000 per month. Purchased $2,500 of supplies on account from Read Supply Company. 7 Paid office rent of $900 cash for the month. 11 Completed a tax assignment and billed client $2,100 for services provided. 12 Received $3,500 advance on a management consulting engagement. 17 Received cash of $1,200 for services completed for H. Arnold Co. 31 Paid secretary-receptionist $2,000 salary for the month. 31 Paid 40% of balance due Read Supply Company. Jane uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 205 Unearned Revenue, No. 301 Jane Kent, Capital; No. 400 Service Revenue, No. 726 Salaries Expense, and No. 729 Rent Expense. Instructions (a) Journalize the transactions. (b) Post to the ledger accounts. (c) Prepare a trial balance on May 31, 2010. Problem 2 Maria Juarez is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April Invested $40,000 cash. Hired a secretary-receptionist at a salary of $600 per week payable monthly. Paid office rent for the month $1,000. Purchased dental supplies on account from Smile Company $4,000. 10 Provided dental services and billed insurance companies $5,100. 11 Received $1,000 cash advance from Trudy Borke for an implant 20 Received $2,100 cash for services completed and delivered to John Stanley. 30 Paid secretary-receptionist for the month $2,400. 30 Paid $1,600 to Smile Company for accounts payable due. Maria uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 205 Unearned Revenue, No. 301 Maria Juarez, Capital; No. 400 Service Revenue, No. 726 Salaries Expense, and No. 729 Rent Expense. Instructions (a) Journalize the transactions. (b) Post to the ledger accounts. (c) Prepare a trial balance on April 30, 2010