Question: PROBLEM 1 Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE

PROBLEM 1

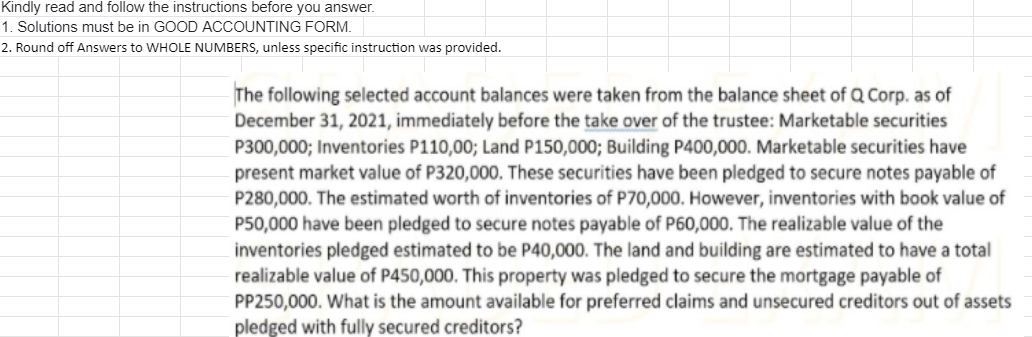

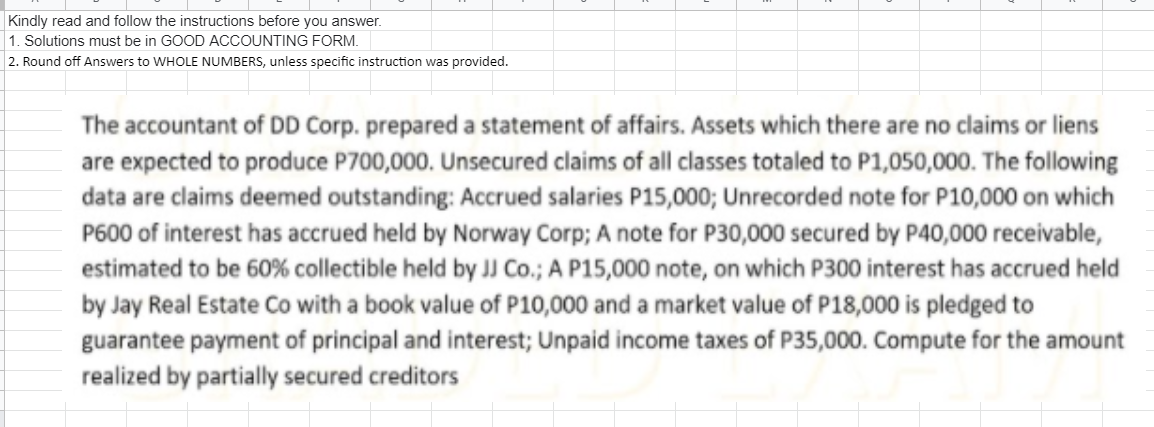

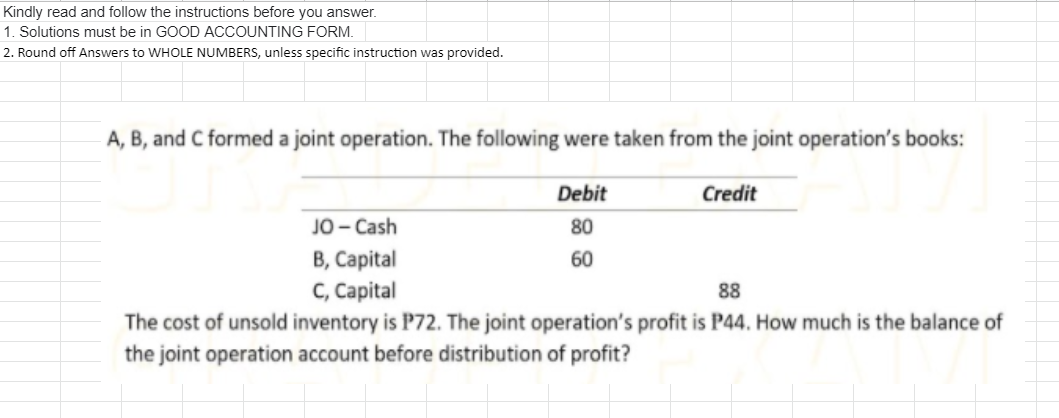

Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. The following selected account balances were taken from the balance sheet of Q Corp. as of December 31, 2021, immediately before the take over of the trustee: Marketable securities P300,000; Inventories P110,00; Land P150,000; Building P400,000. Marketable securities have present market value of P320,000. These securities have been pledged to secure notes payable of P280,000. The estimated worth of inventories of P70,000. However, inventories with book value of P50,000 have been pledged to secure notes payable of P60,000. The realizable value of the inventories pledged estimated to be P40,000. The land and building are estimated to have a total realizable value of P450,000. This property was pledged to secure the mortgage payable of PP250,000. What is the amount available for preferred claims and unsecured creditors out of assets pledged with fully secured creditors?Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. The accountant of DD Corp. prepared a statement of affairs. Assets which there are no claims or liens are expected to produce P700,000. Unsecured claims of all classes totaled to P1,050,000. The following data are claims deemed outstanding: Accrued salaries P15,000; Unrecorded note for P10,000 on which P600 of interest has accrued held by Norway Corp; A note for P30,000 secured by P40,000 receivable, estimated to be 60% collectible held by JJ Co.; A P15,000 note, on which P300 interest has accrued held by Jay Real Estate Co with a book value of P10,000 and a market value of P18,000 is pledged to guarantee payment of principal and interest; Unpaid income taxes of P35,000. Compute for the amount realized by partially secured creditorsKindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. A, B, and C formed a joint operation. The following were taken from the joint operation's books: Debit Credit JO - Cash 80 B, Capital 60 C, Capital 88 The cost of unsold inventory is P72. The joint operation's profit is P44. How much is the balance of the joint operation account before distribution of profit