Question: PROBLEM 1 Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE

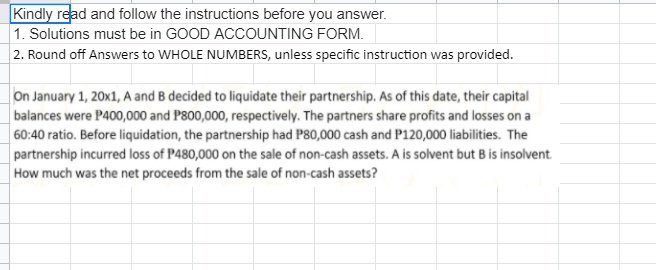

PROBLEM 1

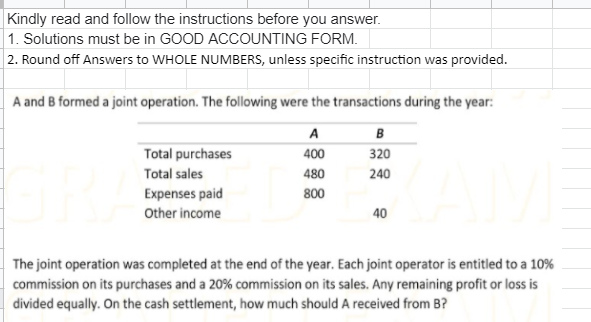

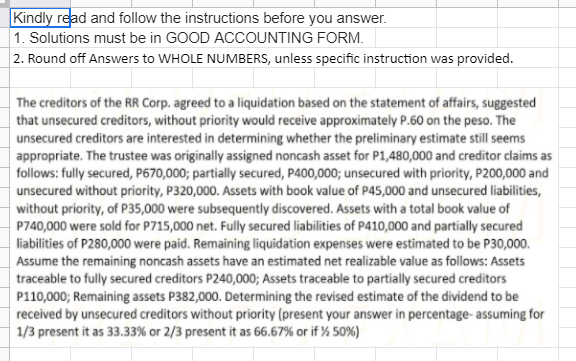

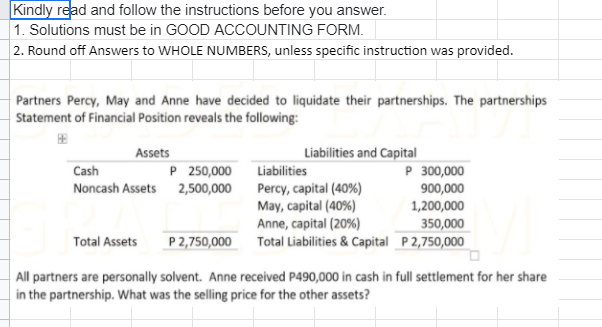

Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. On January 1, 20x1, A and B decided to liquidate their partnership. As of this date, their capital balances were P400,000 and P800,000, respectively. The partners share profits and losses on a 60:40 ratio. Before liquidation, the partnership had P80,000 cash and P120,000 liabilities. The partnership incurred loss of P480,000 on the sale of non-cash assets. A is solvent but B is insolvent. How much was the net proceeds from the sale of non-cash assets?Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. A and B formed a joint operation. The following were the transactions during the year: A B Total purchases 400 320 Total sales 480 240 Expenses paid 800 Other income 40 The joint operation was completed at the end of the year. Each joint operator is entitled to a 10% commission on its purchases and a 20% commission on its sales. Any remaining profit or loss is divided equally. On the cash settlement, how much should A received from B?Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. The creditors of the RR Corp. agreed to a liquidation based on the statement of affairs, suggested that unsecured creditors, without priority would receive approximately P.60 on the peso. The unsecured creditors are interested in determining whether the preliminary estimate still seems appropriate. The trustee was originally assigned noncash asset for P1,480,000 and creditor claims as follows: fully secured, P670,000; partially secured, P400,000; unsecured with priority, P200,000 and unsecured without priority, P320,000. Assets with book value of P45,000 and unsecured liabilities, without priority, of P35,000 were subsequently discovered. Assets with a total book value of P740,000 were sold for P715,000 net. Fully secured liabilities of P410,000 and partially secured liabilities of P280,000 were paid. Remaining liquidation expenses were estimated to be P30,000. Assume the remaining noncash assets have an estimated net realizable value as follows: Assets traceable to fully secured creditors P240,000; Assets traceable to partially secured creditors P110,000; Remaining assets P382,000. Determining the revised estimate of the dividend to be received by unsecured creditors without priority (present your answer in percentage- assuming for 1/3 present it as 33.33% or 2/3 present it as 66.67% or if % 50%)Kindly read and follow the instructions before you answer. 1. Solutions must be in GOOD ACCOUNTING FORM. 2. Round off Answers to WHOLE NUMBERS, unless specific instruction was provided. Partners Percy, May and Anne have decided to liquidate their partnerships. The partnerships Statement of Financial Position reveals the following: Assets Liabilities and Capital Cash P 250,000 Liabilities P 300,000 Noncash Assets 2,500,000 Percy, capital (40%) 900,000 May, capital (40%) 1,200,000 Anne, capital (20%) 350,000 Total Assets P 2,750,000 Total Liabilities & Capital P 2,750,000 All partners are personally solvent. Anne received P490,000 in cash in full settlement for her share in the partnership. What was the selling price for the other assets