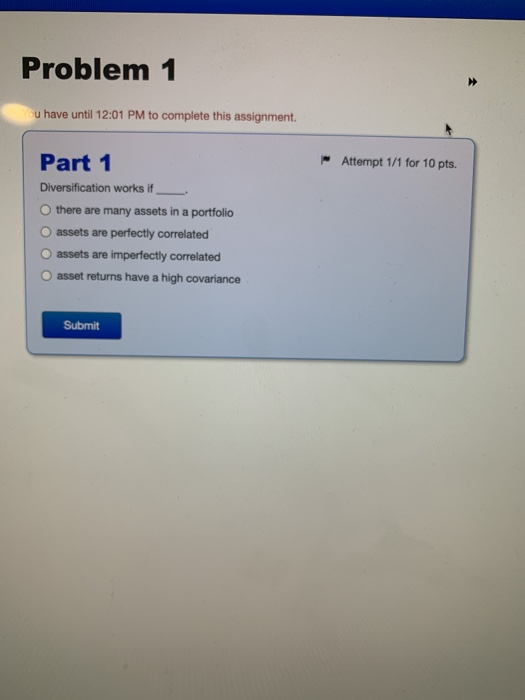

Question: Problem 1 ou have until 12:01 PM to complete this assignment. Attempt 1/1 for 10 pts. Part 1 Diversification works if Othere are many assets

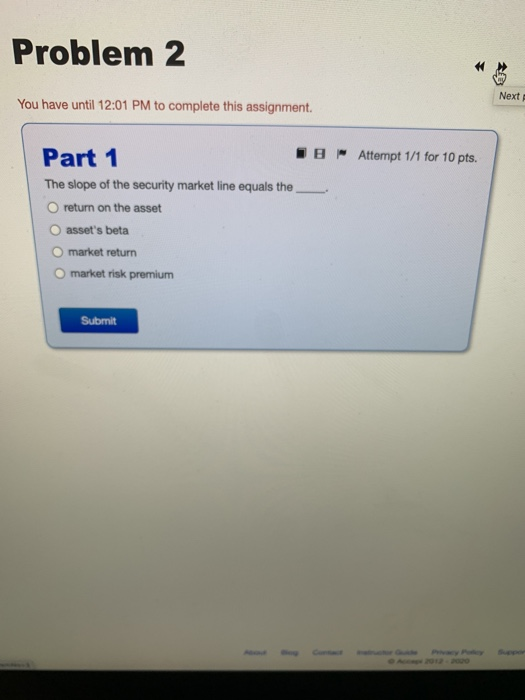

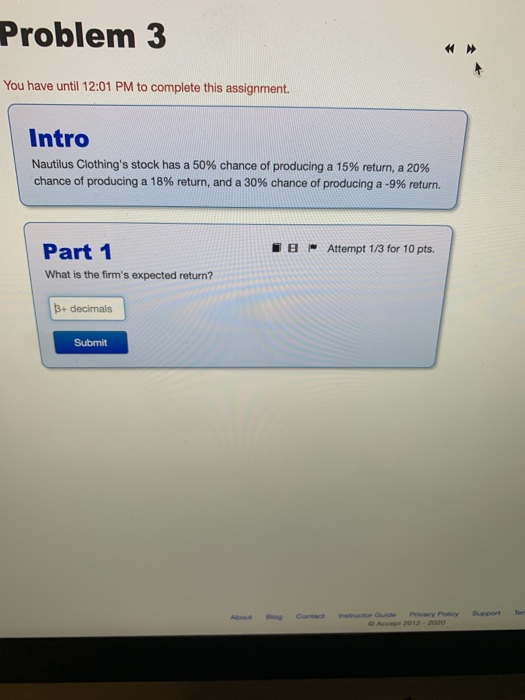

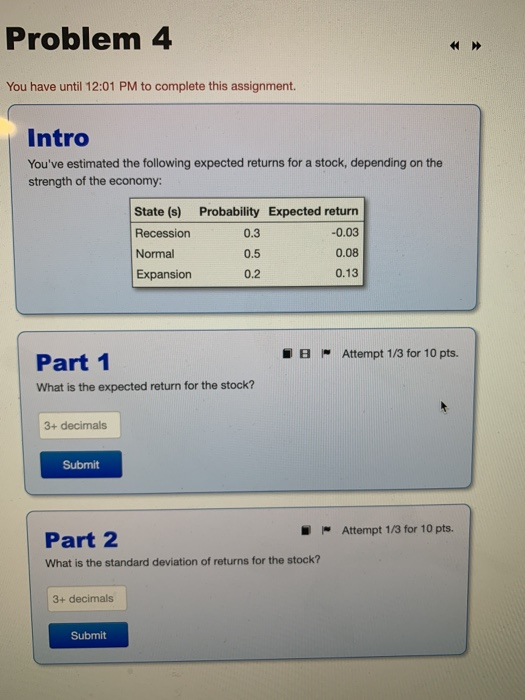

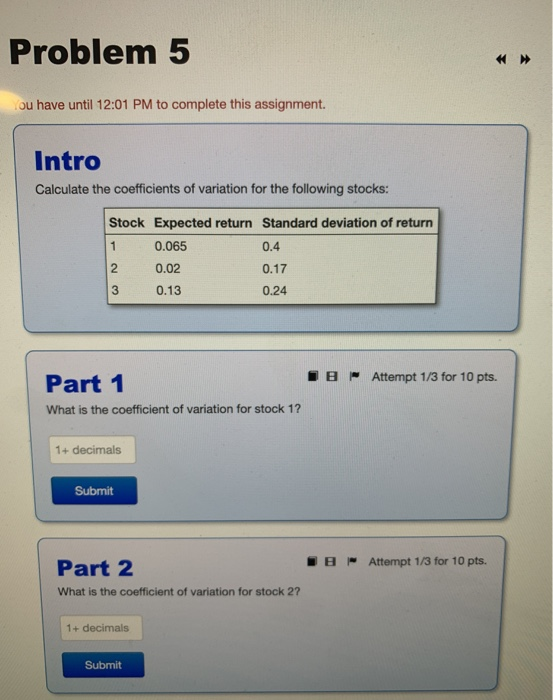

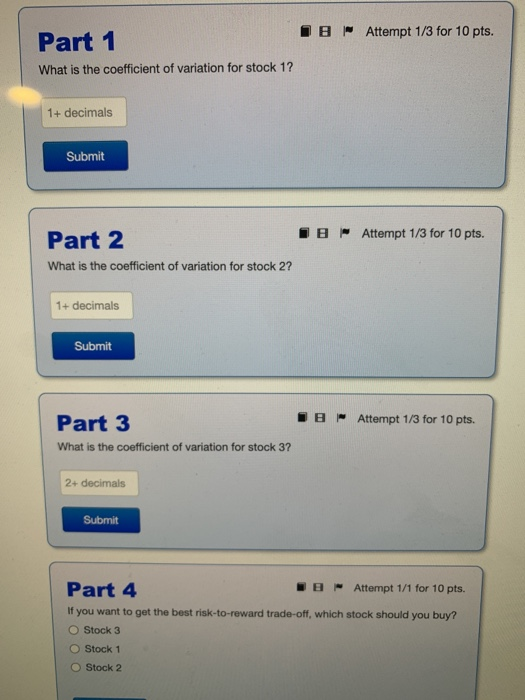

Problem 1 ou have until 12:01 PM to complete this assignment. Attempt 1/1 for 10 pts. Part 1 Diversification works if Othere are many assets in a portfolio O assets are perfectly correlated assets are imperfectly correlated asset returns have a high covariance Submit Problem 2 Next You have until 12:01 PM to complete this assignment. Part 1 JB Attempt 1/1 for 10 pts. The slope of the security market line equals the O return on the asset O asset's beta market return O market risk premium Submit Problem 3 You have until 12:01 PM to complete this assignment. Intro Nautilus Clothing's stock has a 50% chance of producing a 15% return, a 20% chance of producing a 18% return, and a 30% chance of producing a -9% return IB Attempt 1/3 for 10 pts. Part 1 What is the firm's expected return? B+ decimals Submit DAL 2012 - 200 Problem 4 >> You have until 12:01 PM to complete this assignment. Intro You've estimated the following expected returns for a stock, depending on the strength of the economy: State (s) Recession Normal Expansion Probability Expected return 0.3 -0.03 0.5 0.08 0.2 0.13 IB - Attempt 1/3 for 10 pts. Part 1 What is the expected return for the stock? 3+ decimals Submit Attempt 1/3 for 10 pts. Part 2 What is the standard deviation of returns for the stock? 3+ decimals Submit Problem 5 ou have until 12:01 PM to complete this assignment Intro Calculate the coefficients of variation for the following stocks: 1 Stock Expected return Standard deviation of return 0.065 0.4 2 0.02 0.17 3 0.13 0.24 Part 1 IB Attempt 1/3 for 10 pts. What is the coefficient of variation for stock 1? 1+ decimals Submit Part 2 IB Attempt 1/3 for 10 pts. What is the coefficient of variation for stock 2? 1+ decimals Submit Part 1 18 Attempt 1/3 for 10 pts. What is the coefficient of variation for stock 1? 1+ decimals Submit Part 2 IB- Attempt 1/3 for 10 pts. What is the coefficient of variation for stock 2? 1+ decimals Submit - Attempt 1/3 for 10 pts. Part 3 What is the coefficient of variation for stock 3? 2+ decimals Submit Part 4 - Attempt 1/1 for 10 pts. If you want to get the best risk-to-reward trade-off, which stock should you buy? O Stock 3 O Stock 1 O Stock 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts