Question: use excel Problem 1 You have until 2:37 PM to complete this assignment. Intro Now that you've looked at this problem, you must complete it

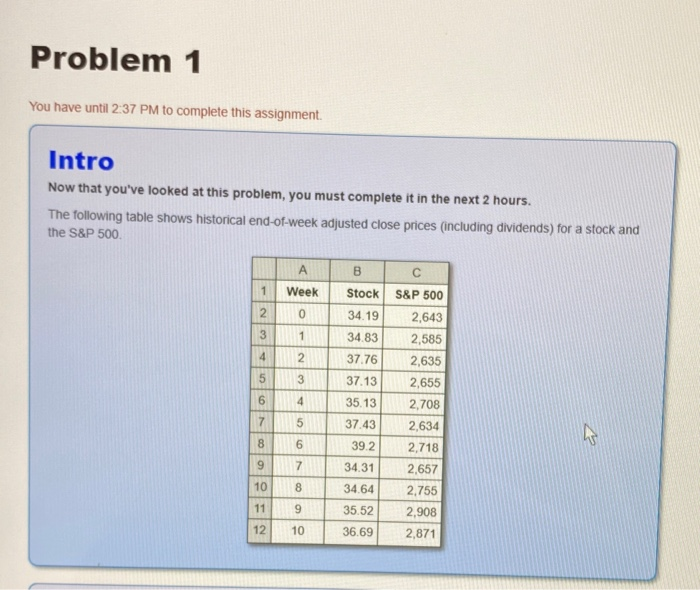

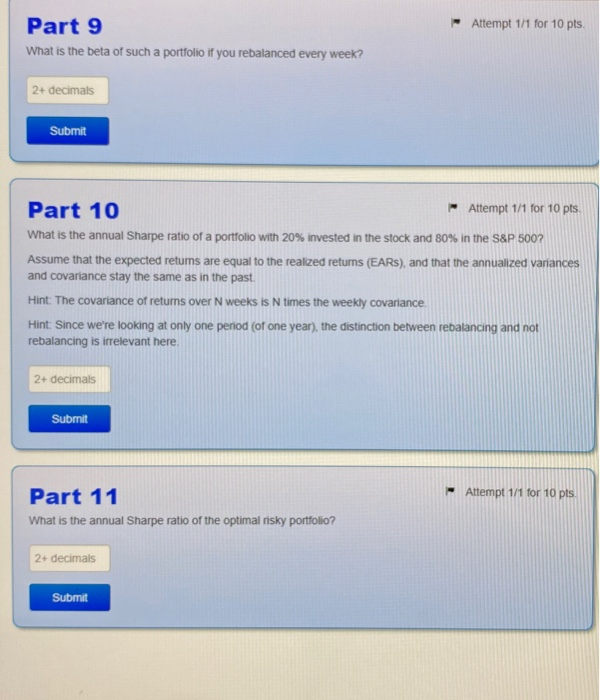

Problem 1 You have until 2:37 PM to complete this assignment. Intro Now that you've looked at this problem, you must complete it in the next 2 hours. The following table shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500 A B 1 Week Stock 2 0 34.19 3 1 34.83 4 2 37.76 5 3 37.13 6 4 35.13 S&P 500 2.643 2,585 2,635 2,655 2,708 2,634 2,718 2.657 2.755 2,908 2,871 7 5 37.43 . 8 6 39.2 9 7 34.31 10 8 34.64 11 9 35.52 12 10 36.69 Attempt 1/1 for 10 pts Part 9 What is the beta of such a portfolio if you rebalanced every week? 2+ decimals Submit Part 10 Attempt 1/1 for 10 pts. What is the annual Sharpe ratio of a portfolio with 20% invested in the stock and 80% in the S&P 500? Assume that the expected returns are equal to the realized returns (EARS), and that the annualized variances and covariance stay the same as in the past. Hint: The covariance of returns over N weeks is N times the weekly covariance Hint: Since we're looking at only one period (of one year), the distinction between rebalancing and not rebalancing is irrelevant here. 2+ decimals Submit Attempt 1/1 for 10 pts. Part 11 What is the annual Sharpe ratio of the optimal risky portfolio? 2+ decimals Submit Problem 1 You have until 2:37 PM to complete this assignment. Intro Now that you've looked at this problem, you must complete it in the next 2 hours. The following table shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500 A B 1 Week Stock 2 0 34.19 3 1 34.83 4 2 37.76 5 3 37.13 6 4 35.13 S&P 500 2.643 2,585 2,635 2,655 2,708 2,634 2,718 2.657 2.755 2,908 2,871 7 5 37.43 . 8 6 39.2 9 7 34.31 10 8 34.64 11 9 35.52 12 10 36.69 Attempt 1/1 for 10 pts Part 9 What is the beta of such a portfolio if you rebalanced every week? 2+ decimals Submit Part 10 Attempt 1/1 for 10 pts. What is the annual Sharpe ratio of a portfolio with 20% invested in the stock and 80% in the S&P 500? Assume that the expected returns are equal to the realized returns (EARS), and that the annualized variances and covariance stay the same as in the past. Hint: The covariance of returns over N weeks is N times the weekly covariance Hint: Since we're looking at only one period (of one year), the distinction between rebalancing and not rebalancing is irrelevant here. 2+ decimals Submit Attempt 1/1 for 10 pts. Part 11 What is the annual Sharpe ratio of the optimal risky portfolio? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts