Question: Problem 1 Part A (15 points) You have been hired as a consultant to help Grewal Footwear, a popular shoe manufacturer with several stores in

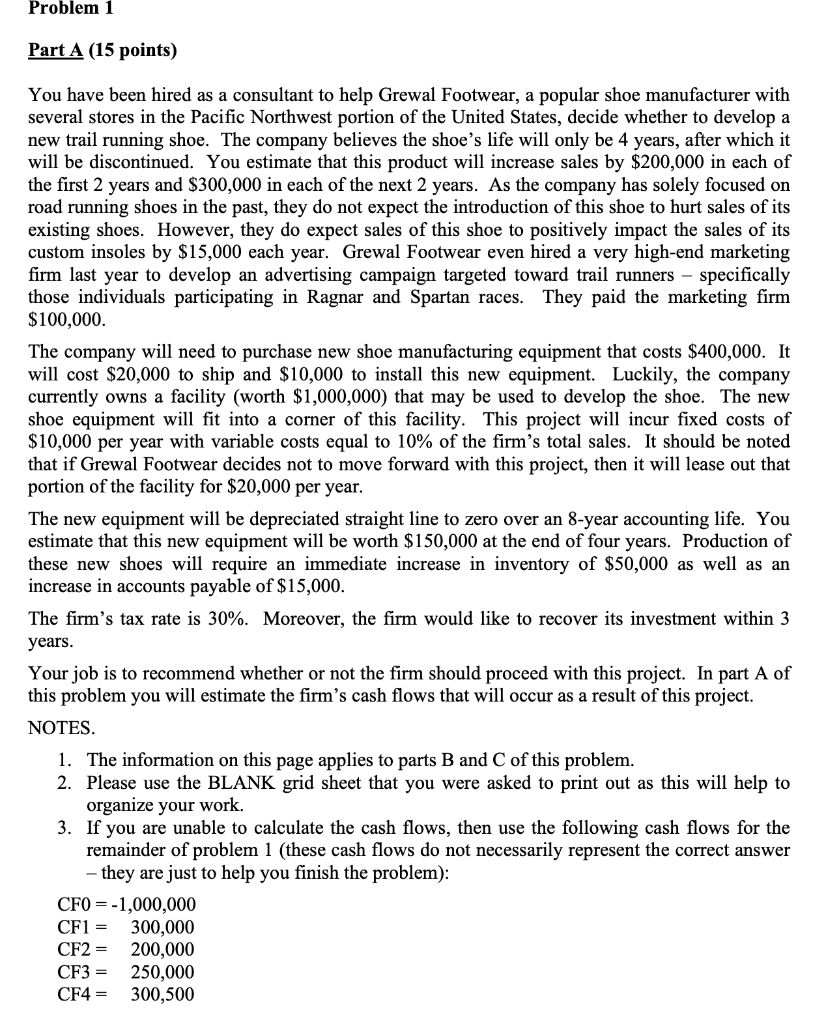

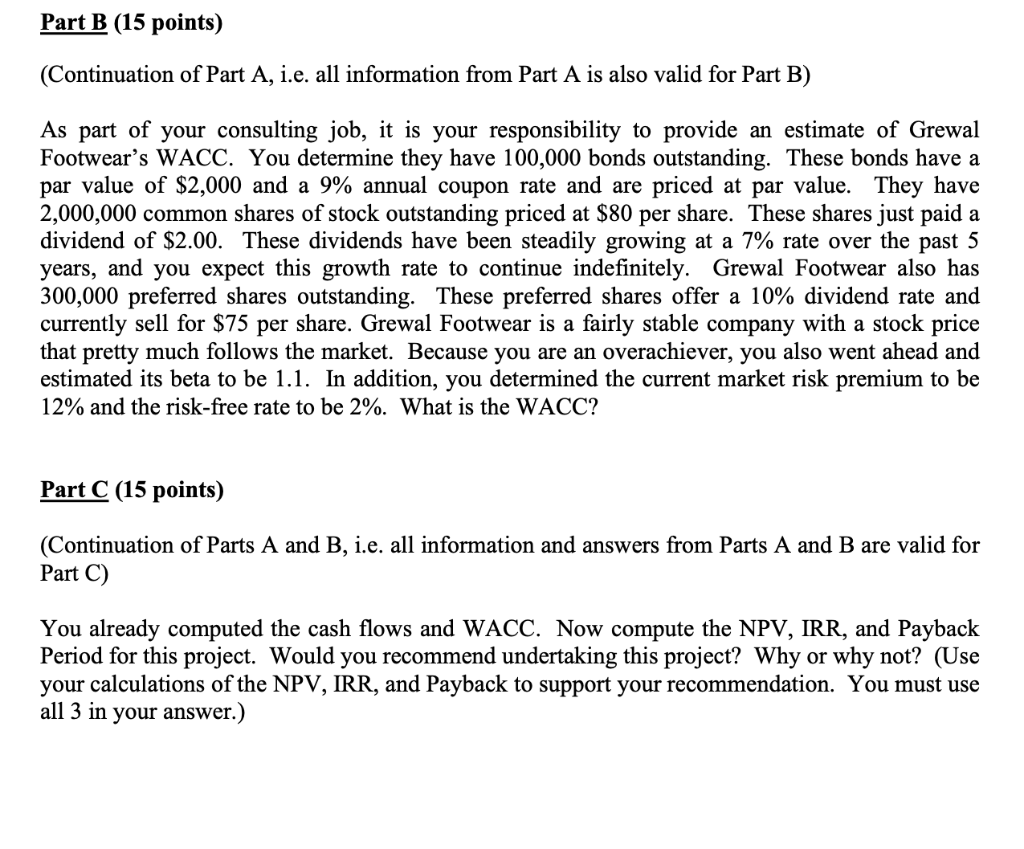

Problem 1 Part A (15 points) You have been hired as a consultant to help Grewal Footwear, a popular shoe manufacturer with several stores in the Pacific Northwest portion of the United States, decide whether to develop a new trail running shoe. The company believes the shoe's life will only be 4 years, after which it will be discontinued. You estimate that this product will increase sales by $200,000 in each of the first 2 years and $300,000 in each of the next 2 years. As the company has solely focused on road running shoes in the past, they do not expect the introduction of this shoe to hurt sales of its existing shoes. However, they do expect sales of this shoe to positively impact the sales of its custom insoles by $15,000 each year. Grewal Footwear even hired a very high-end marketing firm last year to develop an advertising campaign targeted toward trail runners specifically those individuals participating in Ragnar and Spartan races. They paid the marketing firm $100,000. The company will need to purchase new shoe manufacturing equipment that costs $400,000. It will cost $20,000 to ship and $10,000 to install this new equipment. Luckily, the company currently owns a facility (worth $1,000,000) that may be used to develop the shoe. The new shoe equipment will fit into a corner of this facility. This project will incur fixed costs of $10,000 per year with variable costs equal to 10% of the firm's total sales. It should be noted that if Grewal Footwear decides not to move forward with this project, then it will lease out that portion of the facility for $20,000 per year. The new equipment will be depreciated straight line to zero over an 8-year accounting life. You estimate that this new equipment will be worth $150,000 at the end of four years. Production of these new shoes will require an immediate increase in inventory of $50,000 as well as an increase in accounts payable of $15,000. The firm's tax rate is 30%. Moreover, the firm would like to recover its investment within 3 years. Your job is to recommend whether or not the firm should proceed with this project. In part A of this problem you will estimate the firm's cash flows that will occur as a result of this project. NOTES. 1. The information on this page applies to parts B and C of this problem. 2. Please use the BLANK grid sheet that you were asked to print out as this will help to organize your work. 3. If you are unable to calculate the cash flows, then use the following cash flows for the remainder of problem 1 (these cash flows do not necessarily represent the correct answer - they are just to help you finish the problem): CF0= -1,000,000 CF1 = 300,000 CF2 = 200,000 CF3 = 250,000 CF4= 300,500 Part B (15 points) (Continuation of Part A, i.e. all information from Part A is also valid for Part B) As part of your consulting job, it is your responsibility to provide an estimate of Grewal Footwear's WACC. You determine they have 100,000 bonds outstanding. These bonds have a par value of $2,000 and a 9% annual coupon rate and are priced at par value. They have 2,000,000 common shares of stock outstanding priced at $80 per share. These shares just paid a dividend of $2.00. These dividends have been steadily growing at a 7% rate over the past 5 years, and you expect this growth rate to continue indefinitely. Grewal Footwear also has 300,000 preferred shares outstanding. These preferred shares offer a 10% dividend rate and currently sell for $75 per share. Grewal Footwear is a fairly stable company with a stock price that pretty much follows the market. Because you are an overachiever, you also went ahead and estimated its beta to be 1.1. In addition, you determined the current market risk premium to be 12% and the risk-free rate to be 2%. What is the WACC? Part C (15 points) (Continuation of Parts A and B, i.e. all information and answers from Parts A and B are valid for Part 2) You already computed the cash flows and WACC. Now compute the NPV, IRR, and Payback Period for this project. Would you recommend undertaking this project? Why or why not? (Use your calculations of the NPV, IRR, and Payback to support your recommendation. You must use all 3 in your answer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts