Question: Problem 1 - Part A (This is a multi-step problem. If you make an error in the first step, it will carry forward and

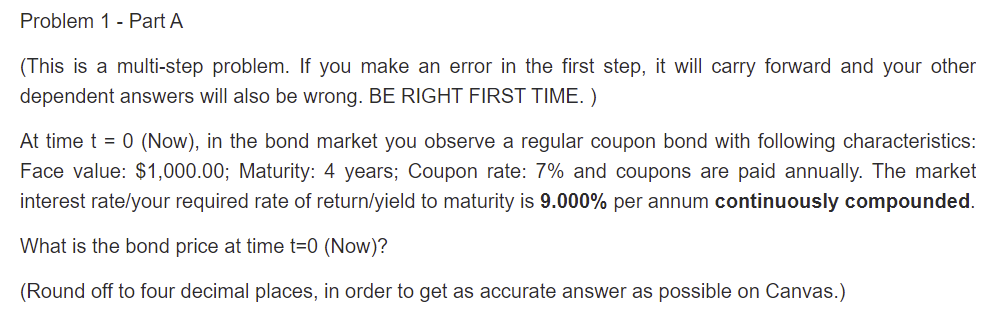

Problem 1 - Part A (This is a multi-step problem. If you make an error in the first step, it will carry forward and your other dependent answers will also be wrong. BE RIGHT FIRST TIME. ) At time t = 0 (Now), in the bond market you observe a regular coupon bond with following characteristics: Face value: $1,000.00; Maturity: 4 years; Coupon rate: 7% and coupons are paid annually. The market interest rate/your required rate of return/yield to maturity is 9.000% per annum continuously compounded. What is the bond price at time t=0 (Now)? (Round off to four decimal places, in order to get as accurate answer as possible on Canvas.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts