Question: Problem # 1 - Part A This problem has two parts: Part A: At t = 0 (Now), you purchase a zero-coupon bond with the

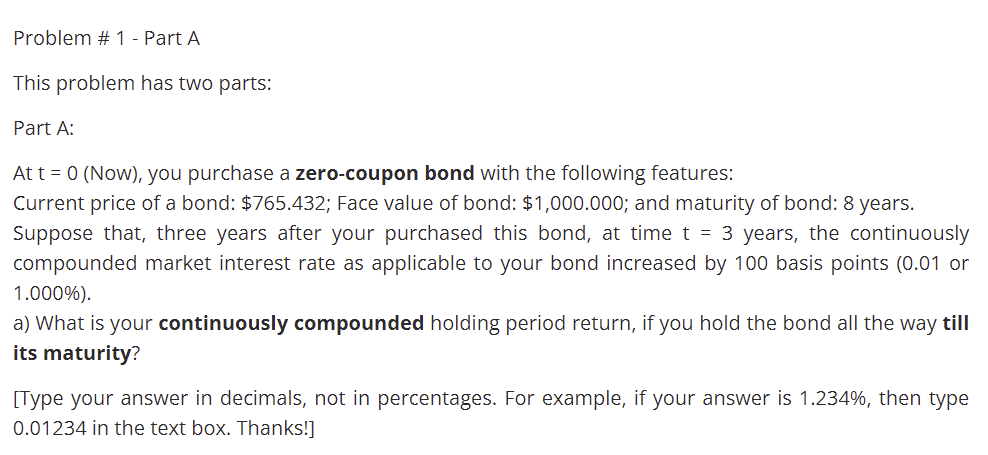

Problem # 1 - Part A This problem has two parts: Part A: At t = 0 (Now), you purchase a zero-coupon bond with the following features: Current price of a bond: $765.432; Face value of bond: $1,000.000; and maturity of bond: 8 years. Suppose that, three years after your purchased this bond, at time t = 3 years, the continuously compounded market interest rate as applicable to your bond increased by 100 basis points (0.01 or 1.000%). a) What is your continuously compounded holding period return, if you hold the bond all the way till its maturity? [Type your answer in decimals, not in percentages. For example, if your answer is 1.234%, then type 0.01234 in the text box. Thanks!]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts