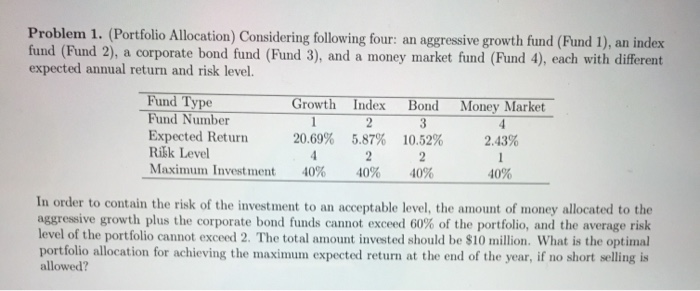

Question: Problem 1. (Portfolio Allocation. Considering following four: an aggressive growth fund (Fund 1), an index fund (Fund 2), a corporate bond fund (Fund 3), and

Problem 1. (Portfolio Allocation. Considering following four: an aggressive growth fund (Fund 1), an index fund (Fund 2), a corporate bond fund (Fund 3), and a money market fund (Fund 4), each with different expected annual return and risk level. Growth Index Bond Money Market Fund Type Fund Number Expected Return Rilk Level Maximum Investment 20.69% 5.87% 2.43% 10.52% 2 40% 40% 40% 40% In order to contain the risk of the investment to an acceptable level, the amount of money allocated to the aggressive growth plus the corporate bond funds cannot exceed 60% of the portfolio, and the average risk level of the portfolio cannot exceed 2. The total amount invested should be $10 million. What is the optimal portfolio allocation for achieving the maximum expected return at the end of the year, if no short selling is allowed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts