Problem #1

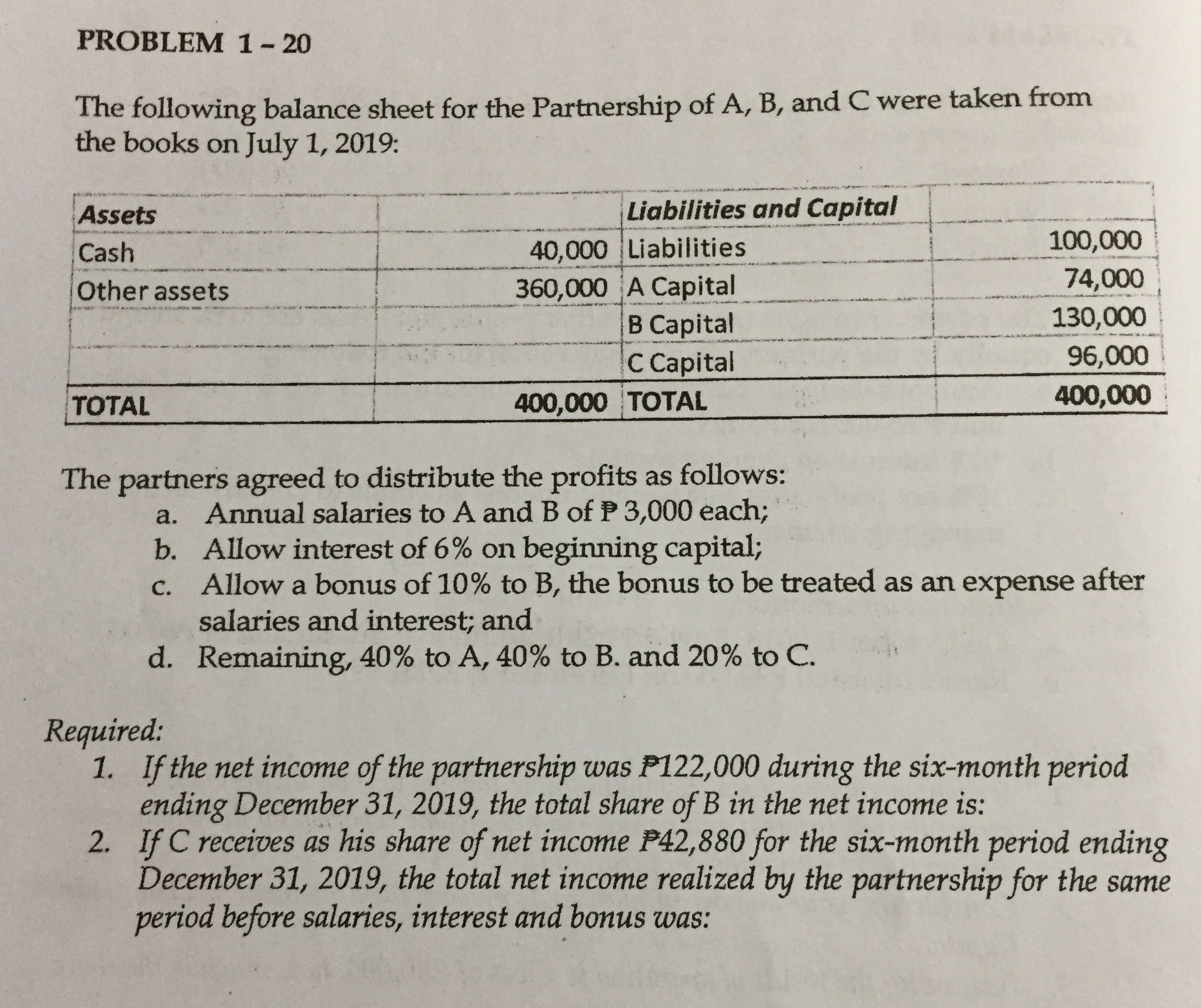

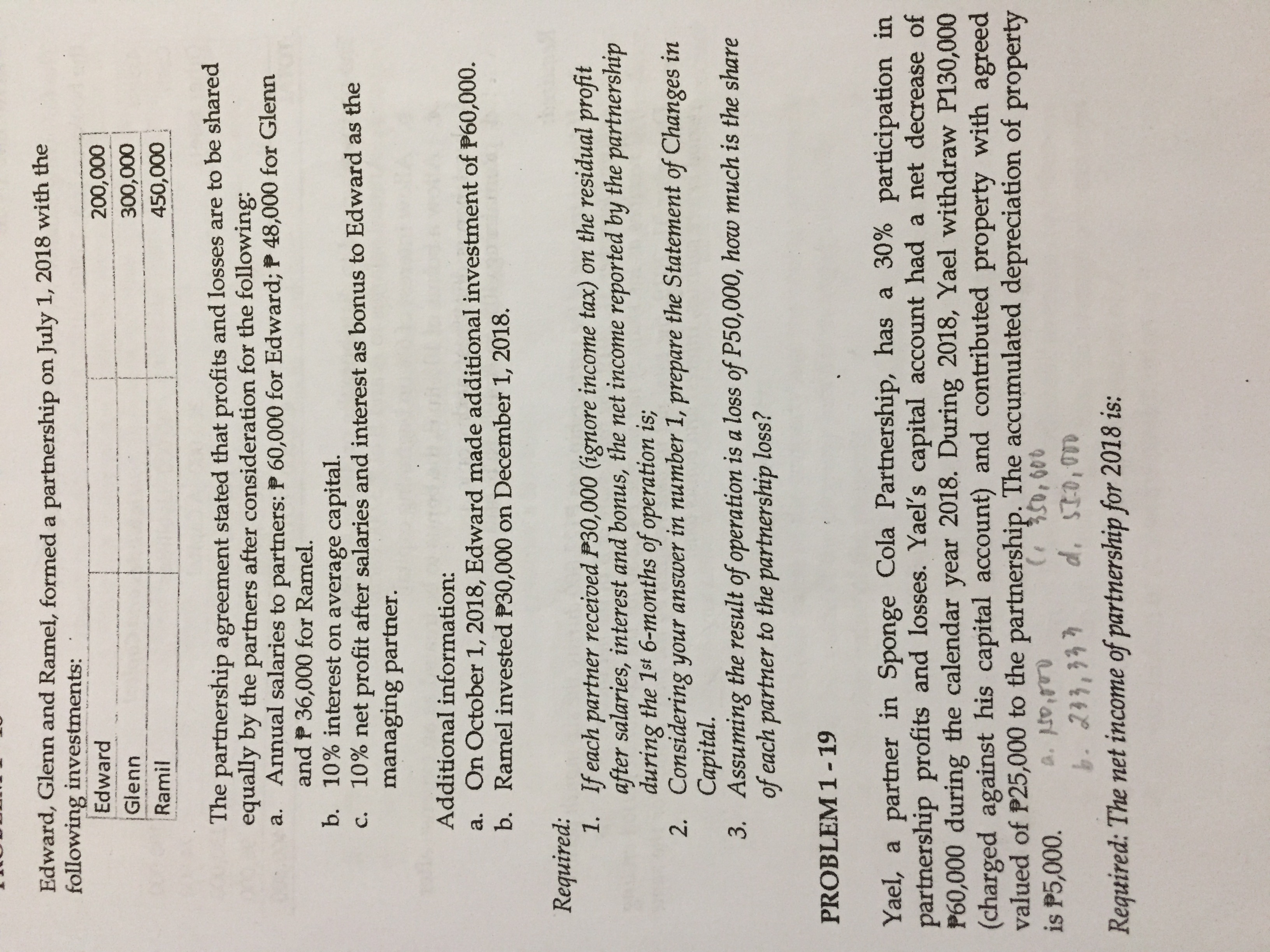

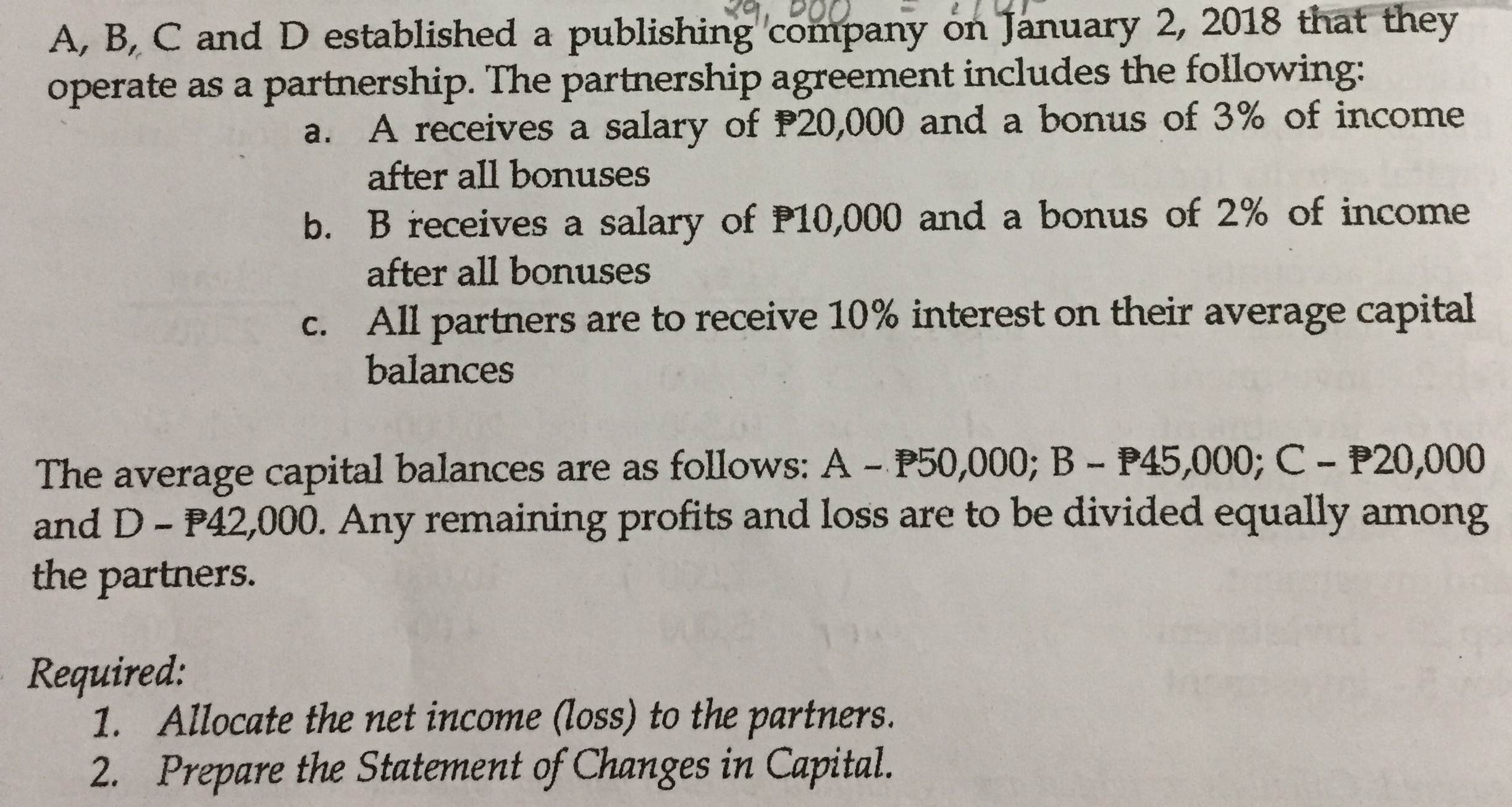

PROBLEM 1 - 20 The following balance sheet for the Partnership of A, B, and C were taken from the books on July 1, 2019: Assets Liabilities and Capital Cash 40,000 Liabilities 100,000 Other assets 360,000 A Capital 74,000 B Capital 130,000 C Capital 96,000 TOTAL 400,000 TOTAL 400,000 The partners agreed to distribute the profits as follows: a. Annual salaries to A and B of P 3,000 each; b. Allow interest of 6% on beginning capital; c. Allow a bonus of 10% to B, the bonus to be treated as an expense after salaries and interest; and d. Remaining, 40% to A, 40% to B. and 20% to C. Required: 1. If the net income of the partnership was P122,000 during the six-month period ending December 31, 2019, the total share of B in the net income is: 2. If C receives as his share of net income P42,880 for the six-month period ending December 31, 2019, the total net income realized by the partnership for the same period before salaries, interest and bonus was:Edward, Glenn and Ramel, formed a partnership on July 1, 2018 with the following investments: Edward 200,000 Glenn 300,000 Ramil 450,000 The partnership agreement stated that profits and losses are to be shared equally by the partners after consideration for the following: a. Annual salaries to partners: P 60,000 for Edward; P 48,000 for Glenn and P 36,000 for Ramel. b. 10% interest on average capital. c. 10% net profit after salaries and interest as bonus to Edward as the managing partner. Additional information: a. On October 1, 2018, Edward made additional investment of P60,000. b. Ramel invested P30,000 on December 1, 2018. Required: 1. If each partner received P30,000 (ignore income tax) on the residual profit after salaries, interest and bonus, the net income reported by the partnership during the Ist 6-months of operation is; 2. Considering your answer in number 1, prepare the Statement of Changes in Capital. 3. Assuming the result of operation is a loss of P50,000, how much is the share of each partner to the partnership loss? PROBLEM 1 - 19 Yael, a partner in Sponge Cola Partnership, has a 30% participation in partnership profits and losses. Yael's capital account had a net decrease of P60,000 during the calendar year 2018. During 2018, Yael withdraw P130,000 (charged against his capital account) and contributed property with agreed valued of P25,000 to the partnership. The accumulated depreciation of property is P5,000. ( 950, 600 6. 233, 33 3 d, $7:0, 000 Required: The net income of partnership for 2018 is:A, B, C and D established a publishing company on January 2, 2018 that they operate as a partnership. The partnership agreement includes the following: a. A receives a salary of P20,000 and a bonus of 3% of income after all bonuses b. B receives a salary of P10,000 and a bonus of 2% of income after all bonuses c. All partners are to receive 10% interest on their average capital balances The average capital balances are as follows: A - P50,000; B - P45,000; C - P20,000 and D - P42,000. Any remaining profits and loss are to be divided equally among the partners. Required: 1. Allocate the net income (loss) to the partners. 2. Prepare the Statement of Changes in Capital