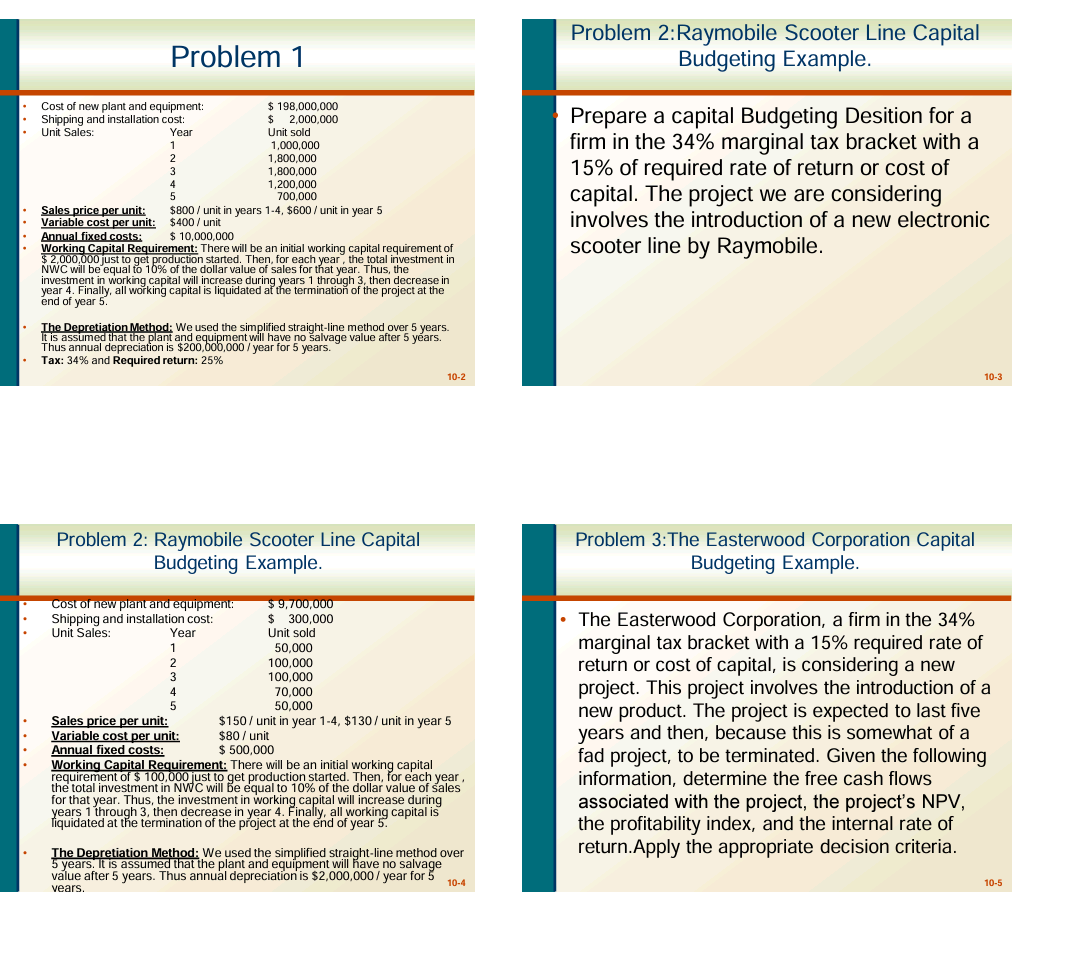

Question: Problem 1 Problem 2 :Raymobile Scooter Line Capital Budgeting Example. Prepare a capital Budgeting Desition for a firm in the 3 4 % marginal tax

Problem

Problem :Raymobile Scooter Line Capital Budgeting Example.

Prepare a capital Budgeting Desition for a firm in the marginal tax bracket with a of required rate of return or cost of capital. The project we are considering involves the introduction of a new electronic scooter line by Raymobile.

Problem : Raymobile Scooter Line Capital Budgeting Example.

Problem :The Easterwood Corporation Capital Budgeting Example.

The Easterwood Corporation, a firm in the marginal tax bracket with a required rate of return or cost of capital, is considering a new project. This project involves the introduction of a new product. The project is expected to last five years and then, because this is somewhat of a fad project, to be terminated. Given the following information, determine the free cash flows associated with the project, the project's NPV the profitability index, and the internal rate of return.Apply the appropriate decision criteria.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock