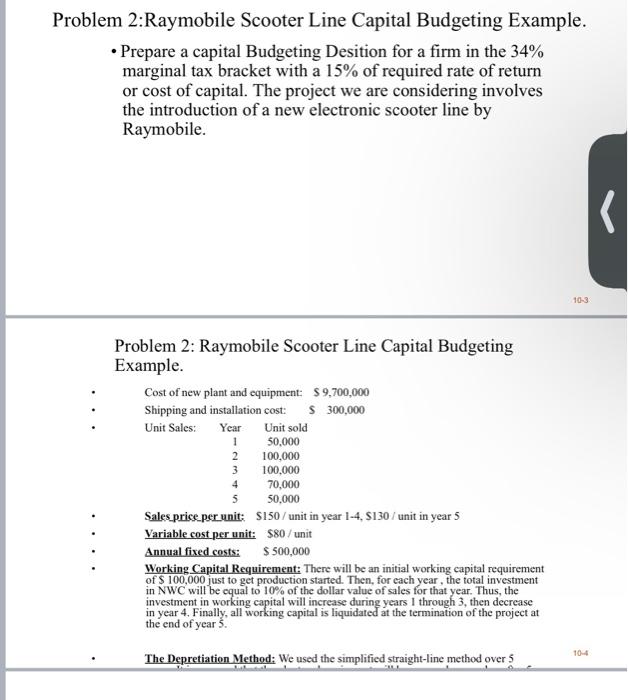

Question: Problem 2:Raymobile Scooter Line Capital Budgeting Example. Prepare a capital Budgeting Desition for a firm in the 34% marginal tax bracket with a 15% of

Problem 2:Raymobile Scooter Line Capital Budgeting Example. - Prepare a capital Budgeting Desition for a firm in the 34% marginal tax bracket with a 15% of required rate of return or cost of capital. The project we are considering involves the introduction of a new electronic scooter line by Raymobile. Problem 2: Raymobile Scooter Line Capital Budgeting Example. Sales_price_per unit: $150/ unit in year 14,$130/ unit in year 5 Variable cost per unit: $80/ unit Annual fixed costs: $500,000 Working Capital Requirement: There will be an initial working capital requirement of $100,000 just to get production started. Then, for each year, the total investment in NWC will be equal to 10% of the dollar value of sales for that year. Thus, the investment in working capital will increase during years I through 3 , then decrease in year 4. Finally, all working capital is liquidated at the termination of the project at the end of year 5 . The Depretiation Method: We used the simplified straight-line method over 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts