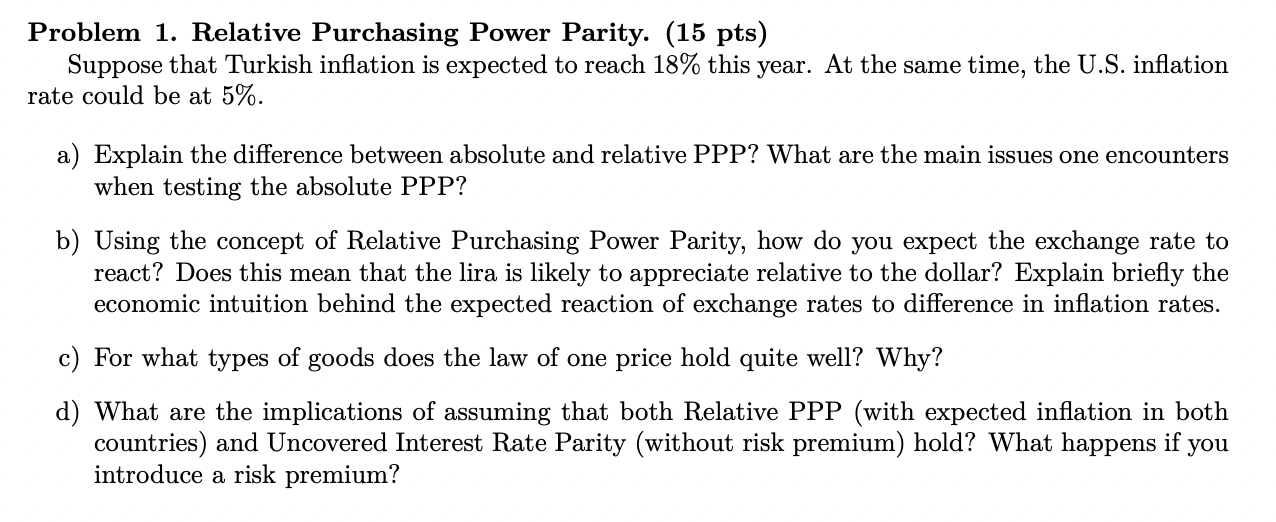

Question: Problem 1. Relative Purchasing Power Parity. (15 pts) Suppose that Turkish ination is expected to reach 18% this year. At the same time, the U.S.

Problem 1. Relative Purchasing Power Parity. (15 pts) Suppose that Turkish ination is expected to reach 18% this year. At the same time, the U.S. ination rate could be at 5%. a) Explain the difference between absolute and relative PPP? What are the main issues one encounters when testing the absolute PPP? b) Using the concept of Relative Purchasing Power Parity, how do you expect the exchange rate to react? Does this mean that the lira is likely to appreciate relative to the dollar? Explain briey the economic intuition behind the expected reaction of exchange rates to difference in ination rates. 0) For what types of goods does the law of one price hold quite well? Why? d) What are the implications of assuming that both Relative PPP (with expected ination in both countries) and Uncovered Interest Rate Parity (without risk premium) hold? What happens if you introduce a risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts