Question: Problem 1.) The UMN bookstore is stocking a new textbookfor a course that will be offered only once. The book will costthem $40 per copy

Problem 1.) The UMN bookstore is stocking a new textbookfor a course that will be offered only once. The book will costthem $40 per copy (including all shipping and handling costs), andwill retail for $60. After the course is over, the book can be soldto a used bookseller at $10 per copy. The bookstore estimates thatdemand for the textbook is distributed D ? N (60, 252 ). Printing acopy of the textbook (including royalty fees, etc.) costs thepublisher, ABCU Press, $14.

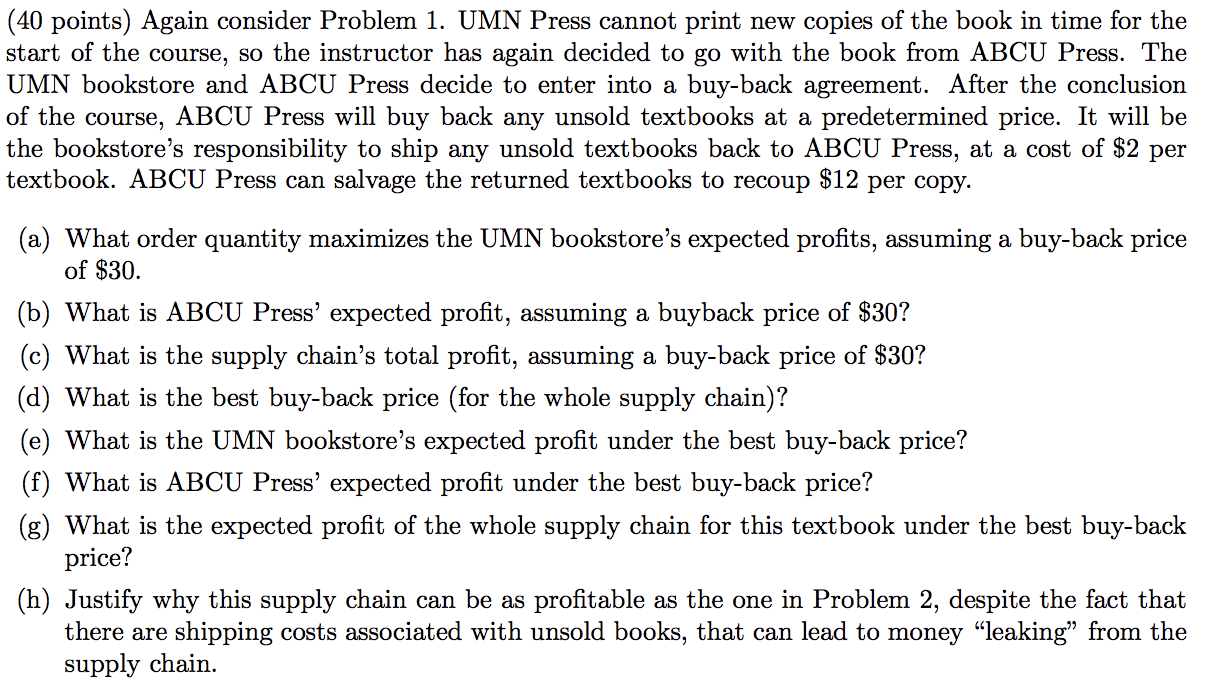

(40 points) Again consider Problem 1. UMN Press cannot print new copies of the book in time for the start of the course, so the instructor has again decided to go with the book from ABCU Press. The UMN bookstore and ABCU Press decide to enter into a buy-back agreement. After the conclusion of the course, ABCU Press will buy back any unsold textbooks at a predetermined price. It will be the bookstore's responsibility to ship any unsold textbooks back to ABCU Press, at a cost of $2 per textbook. ABCU Press can salvage the returned textbooks to recoup $12 per copy. (a) What order quantity maximizes the UMN bookstore's expected profits, assuming a buy-back price of $30. (b) What is ABCU Press' expected profit, assuming a buyback price of $30? (c) What is the supply chain's total profit, assuming a buy-back price of $30? (d) What is the best buy-back price (for the whole supply chain)? (e) What is the UMN bookstore's expected profit under the best buy-back price? (f) What is ABCU Press' expected profit under the best buy-back price? (g) What is the expected profit of the whole supply chain for this textbook under the best buy-back price? (h) Justify why this supply chain can be as profitable as the one in Problem 2, despite the fact that there are shipping costs associated with unsold books, that can lead to money leaking from the supply chain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts