Question: Problem 1 There is a mortgage pool containing 100 fixed-rate mortgages, and all these mortgages have the same size of $300,000, the same maturity of

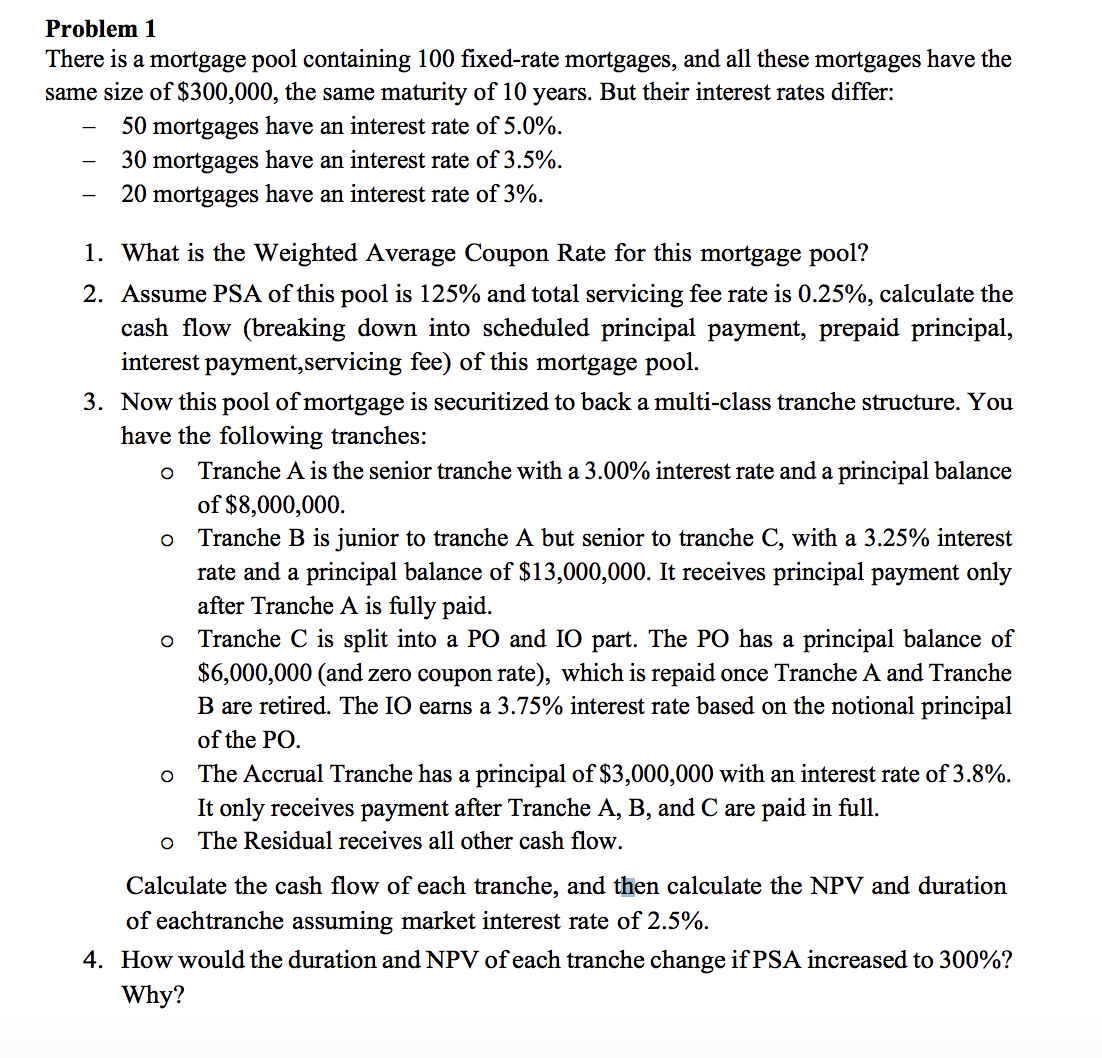

Problem 1 There is a mortgage pool containing 100 fixed-rate mortgages, and all these mortgages have the same size of $300,000, the same maturity of 10 years. But their interest rates differ: 50 mortgages have an interest rate of 5.0%. 30 mortgages have an interest rate of 3.5%. 20 mortgages have an interest rate of 3%. O 1. What is the Weighted Average Coupon Rate for this mortgage pool? 2. Assume PSA of this pool is 125% and total servicing fee rate is 0.25%, calculate the cash flow (breaking down into scheduled principal payment, prepaid principal, interest payment,servicing fee) of this mortgage pool. 3. Now this pool of mortgage is securitized to back a multi-class tranche structure. You have the following tranches: Tranche A is the senior tranche with a 3.00% interest rate and a principal balance of $8,000,000. o Tranche B is junior to tranche A but senior to tranche C, with a 3.25% interest rate and a principal balance of $13,000,000. It receives principal payment only after Tranche A is fully paid. Tranche C is split into a PO and IO part. The PO has a principal balance of $6,000,000 (and zero coupon rate), which is repaid once Tranche A and Tranche B are retired. The 10 earns a 3.75% interest rate based on the notional principal of the PO. o The Accrual Tranche has a principal of $3,000,000 with an interest rate of 3.8%. It only receives payment after Tranche A, B, and C are paid in full. The Residual receives all other cash flow. o O Calculate the cash flow of each tranche, and then calculate the NPV and duration of eachtranche assuming market interest rate of 2.5%. 4. How would the duration and NPV of each tranche change if PSA increased to 300%? Why? Problem 1 There is a mortgage pool containing 100 fixed-rate mortgages, and all these mortgages have the same size of $300,000, the same maturity of 10 years. But their interest rates differ: 50 mortgages have an interest rate of 5.0%. 30 mortgages have an interest rate of 3.5%. 20 mortgages have an interest rate of 3%. O 1. What is the Weighted Average Coupon Rate for this mortgage pool? 2. Assume PSA of this pool is 125% and total servicing fee rate is 0.25%, calculate the cash flow (breaking down into scheduled principal payment, prepaid principal, interest payment,servicing fee) of this mortgage pool. 3. Now this pool of mortgage is securitized to back a multi-class tranche structure. You have the following tranches: Tranche A is the senior tranche with a 3.00% interest rate and a principal balance of $8,000,000. o Tranche B is junior to tranche A but senior to tranche C, with a 3.25% interest rate and a principal balance of $13,000,000. It receives principal payment only after Tranche A is fully paid. Tranche C is split into a PO and IO part. The PO has a principal balance of $6,000,000 (and zero coupon rate), which is repaid once Tranche A and Tranche B are retired. The 10 earns a 3.75% interest rate based on the notional principal of the PO. o The Accrual Tranche has a principal of $3,000,000 with an interest rate of 3.8%. It only receives payment after Tranche A, B, and C are paid in full. The Residual receives all other cash flow. o O Calculate the cash flow of each tranche, and then calculate the NPV and duration of eachtranche assuming market interest rate of 2.5%. 4. How would the duration and NPV of each tranche change if PSA increased to 300%? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts