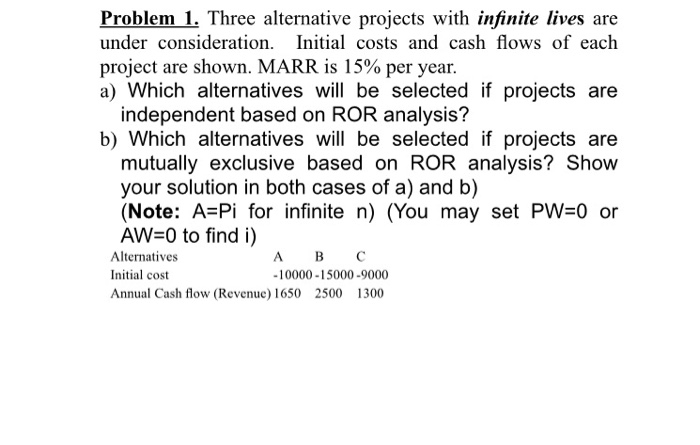

Question: Problem 1. Three alternative projects with infinite lives are under consideration. Initial costs and cash flows of each project are shown. MARR is 15% per

Problem 1. Three alternative projects with infinite lives are under consideration. Initial costs and cash flows of each project are shown. MARR is 15% per year. a) Which alternatives will be selected if projects are independent based on ROR analysis? b) Which alternatives will be selected if projects are mutually exclusive based on ROR analysis? Show your solution in both cases of a) and b) (Note: A=Pi for infinite n) (You may set PW=0 or AW=0 to find i) Alternatives A B Initial cost -10000 - 15000-9000 Annual Cash flow (Revenue) 1650 2500 1300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts