Question: Problem #1 Using the efficient portfolio instead of the SP500: a. Compute the monthly returns on the efficient portfolio. b. Regress the average monthly returns

Problem #1

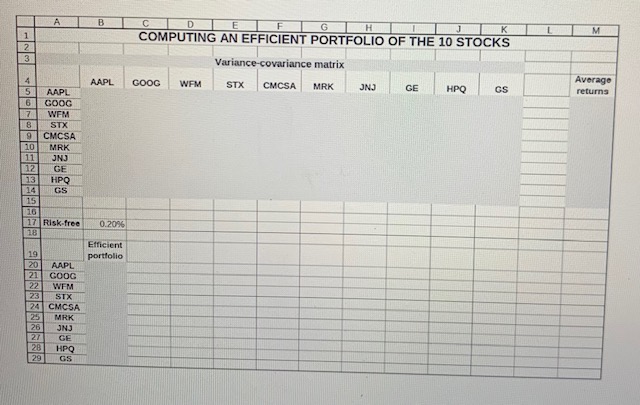

Using the efficient portfolio instead of the SP500:

a. Compute the monthly returns on the efficient portfolio. b. Regress the average monthly returns of the stocks on their betas with respect to the efficient portfolio. c. Explain your results

Part b)

Perform the second-pass regression: Regress the monthly average returns on the betas of the assets. Does this confirm that the SP500 is efficient?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts