Question: Problem 1: VaRious Considerations You are a hedge fund manager with a portfolio of $500 million. The historical return distribution of your portfolio is assumed

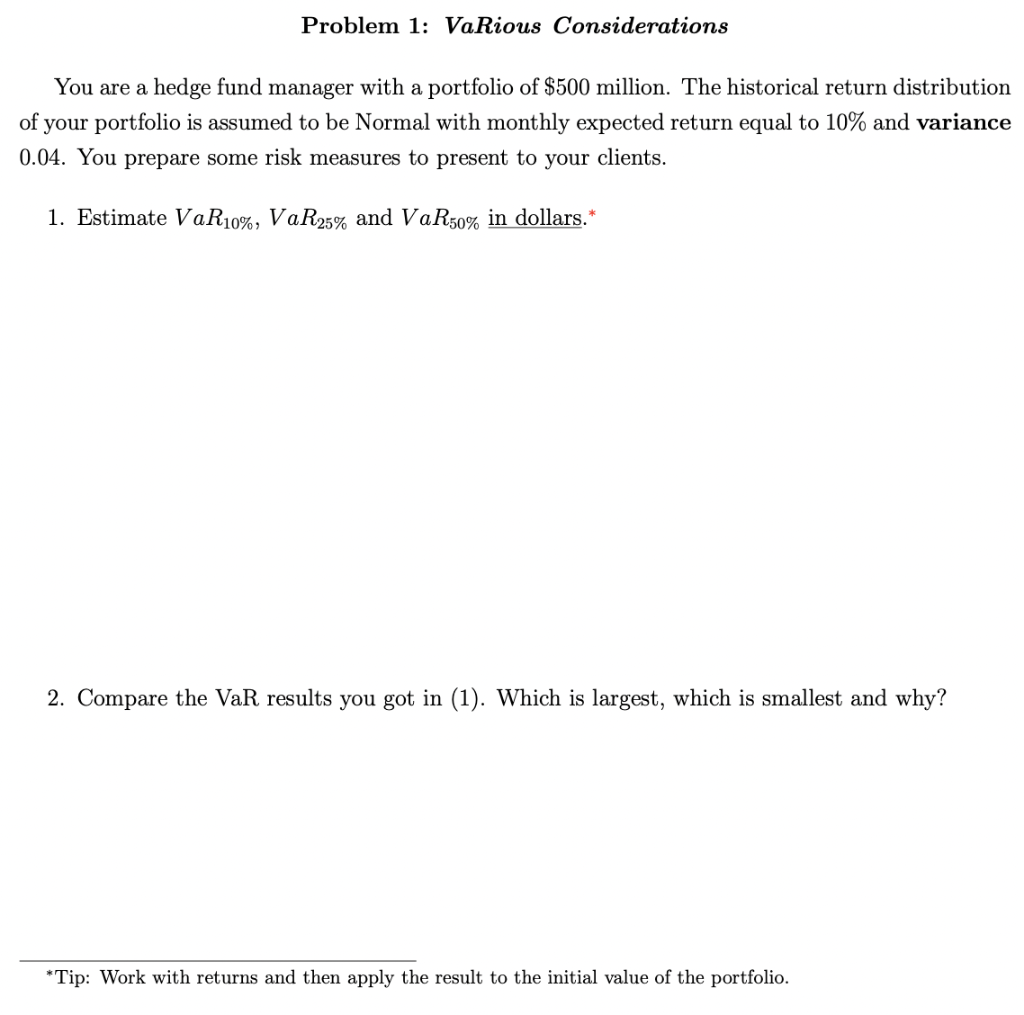

Problem 1: VaRious Considerations You are a hedge fund manager with a portfolio of $500 million. The historical return distribution of your portfolio is assumed to be Normal with monthly expected return equal to 10% and variance 0.04. You prepare some risk measures to present to your clients. 1. Estimate VaR10%, VaR25% and VaR50% in dollars.* 2. Compare the VaR results you got in (1). Which is largest, which is smallest and why? * Tip: Work with returns and then apply the result to the initial value of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts