Question: Problem 1: -- W dll your work): Gabrielle just won $2.75 million in the state lottery. She is given the option of receiving a total

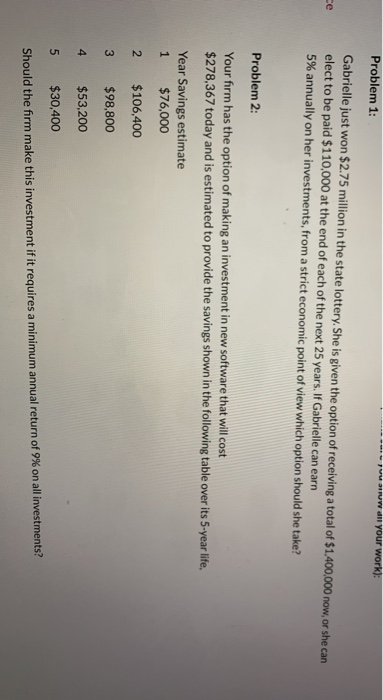

Problem 1: -- W dll your work): Gabrielle just won $2.75 million in the state lottery. She is given the option of receiving a total of $1,400,000 now, or she can elect to be paid $110,000 at the end of each of the next 25 years. If Gabrielle can earn 5% annually on her investments, from a strict economic point of view which option should she take? Problem 2: Your firm has the option of making an investment in new software that will cost $278,367 today and is estimated to provide the savings shown in the following table over its 5-year life. Year Savings estimate $76,000 1 2 $106,400 3 $98,800 4 $53,200 5 $30,400 Should the firm make this investment if it requires a minimum annual return of 9% on all investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts