Question: Problem 1. Wewant to study the effects ofdiversification on expected returns. Instead of holding only b ond B or stockS, we puta fraction wB of

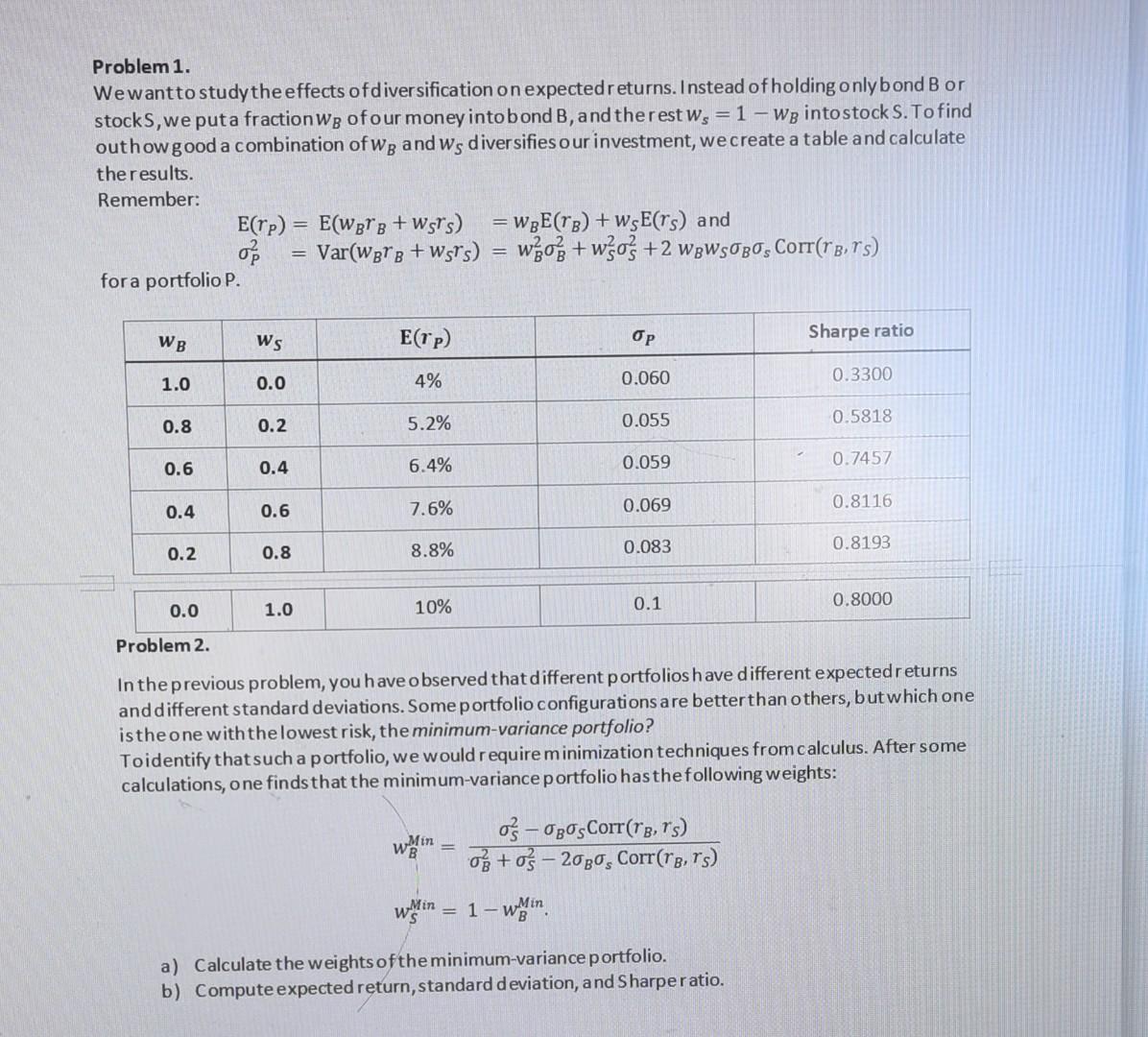

Problem 1. Wewant to study the effects ofdiversification on expected returns. Instead of holding only b ond B or stockS, we puta fraction wB of our money intobond B, and the rest ws=1wB intostock S. To find outhow good a combination of wB and wS diver sifiesour investment, we create a table and calculate theresults. Remember: E(rP)=E(wBrB+wSrS)=wBE(rB)+wSE(rS)andP2=Var(wBrB+wSrS)=wB2B2+wS2S2+2wBwSBSCorr(rB,rS) for a portfolio P. Problem 2. In the previous problem, you have observed that different portfoliosh ave different expected returns and different standard deviations. Some portfolio configurations are better than others, but which one is the one with the lowest risk, the minimum-variance portfolio? Toidentify that such a portfolio, we would r equire minimization techniques from calculus. After some calculations, one finds that the minimum-variance portfolio has the following weights: wBMin=B2+S22BsCorr(rB,rS)S2BSCorr(rB,rS)wSMin=1wBMin. a) Calculate the weights of the minimum-variance portfolio. b) Compute expected return, standard deviation, and Sharpe ratio. Problem 1. Wewant to study the effects ofdiversification on expected returns. Instead of holding only b ond B or stockS, we puta fraction wB of our money intobond B, and the rest ws=1wB intostock S. To find outhow good a combination of wB and wS diver sifiesour investment, we create a table and calculate theresults. Remember: E(rP)=E(wBrB+wSrS)=wBE(rB)+wSE(rS)andP2=Var(wBrB+wSrS)=wB2B2+wS2S2+2wBwSBSCorr(rB,rS) for a portfolio P. Problem 2. In the previous problem, you have observed that different portfoliosh ave different expected returns and different standard deviations. Some portfolio configurations are better than others, but which one is the one with the lowest risk, the minimum-variance portfolio? Toidentify that such a portfolio, we would r equire minimization techniques from calculus. After some calculations, one finds that the minimum-variance portfolio has the following weights: wBMin=B2+S22BsCorr(rB,rS)S2BSCorr(rB,rS)wSMin=1wBMin. a) Calculate the weights of the minimum-variance portfolio. b) Compute expected return, standard deviation, and Sharpe ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts