Question: Problem 1 X and Y are two fast growing companies in the engineering industry. They are close competitors and their asset composition, capital structure, and

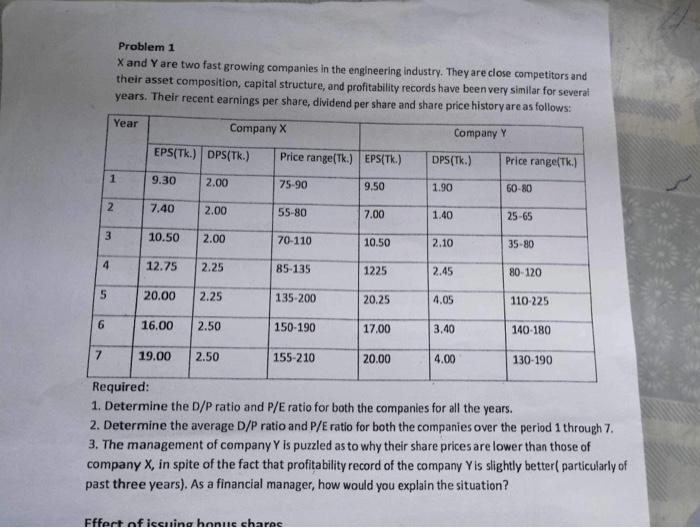

Problem 1 X and Y are two fast growing companies in the engineering industry. They are close competitors and their asset composition, capital structure, and profitability records have been very similar for severaf years. Their recent earnings per share, dividend per share and share price history are as follows: Required: 1. Determine the D/P ratio and P/E ratio for both the companies for all the years. 2. Determine the average D/P ratio and P/ ratio for both the companies over the period 1 through 7 . 3. The management of company Y is puzzled as to why their share prices are lower than those of company X, in spite of the fact that profitability record of the company Y is slightly better( particularly of past three years). As a financial manager, how would you explain the situation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts