Question: Problem 1. You sell two Put options expiring in 2 years with a strike price of $40. The current price of the underlying is $38,

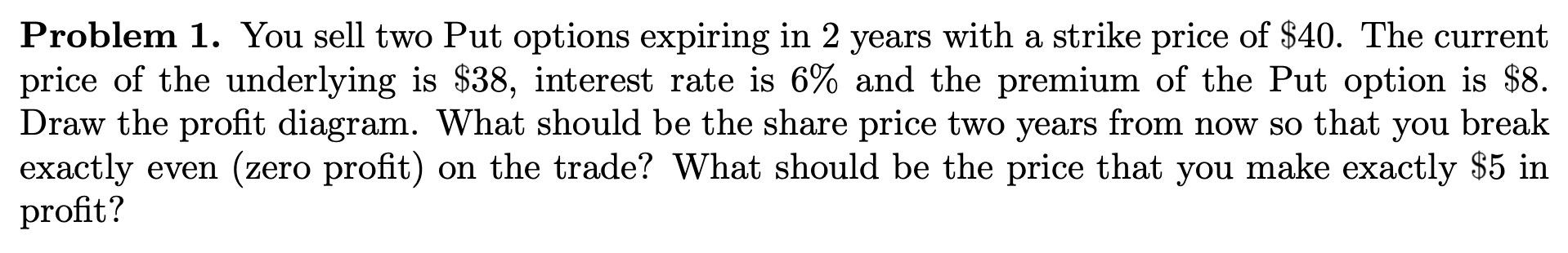

Problem 1. You sell two Put options expiring in 2 years with a strike price of $40. The current price of the underlying is $38, interest rate is 6% and the premium of the Put option is $8. Draw the profit diagram. What should be the share price two years from now so that you break exactly even (zero profit) on the trade? What should be the price that you make exactly $5 in profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts