Question: Problem 1 Your company is considering purchasing a machine now for $ 1 million. Because of this machine, the company would generate an additional $

Problem

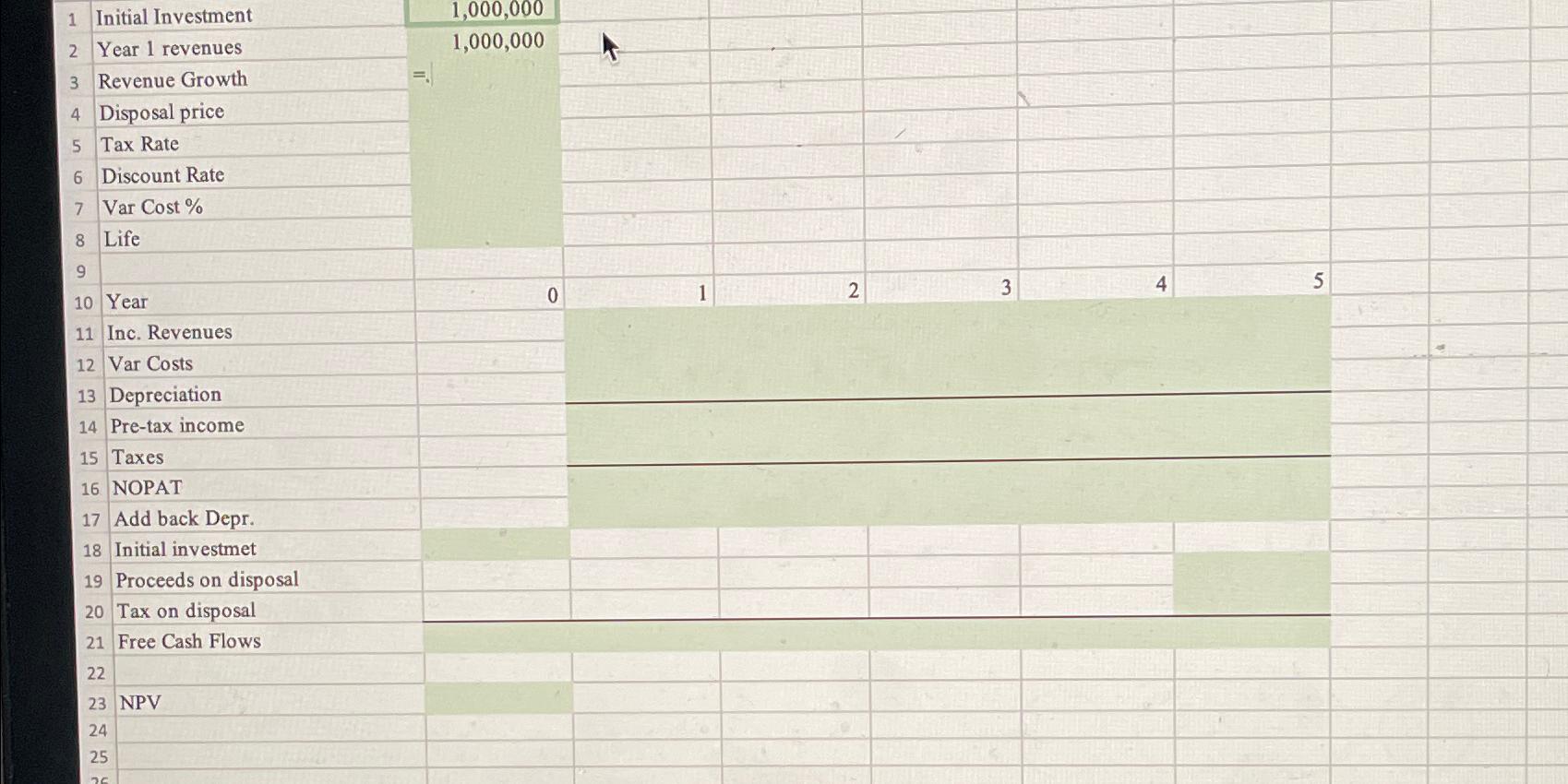

Your company is considering purchasing a machine now for $ million. Because of this machine, the company would generate an additional $ million in revenue in year and each year after year the revenue would grow by However, there are some costs associated with the machine. Variable costs each year would be of revenue, and you would have to take depreciation expense using the straightline method over five years to depreciate the total $ million. Your company could dispose of the machine in year for $ The tax rate is and the discount rate is

Year revenues

Revenue Growth

Disposal price

Tax Rate

Discount Rate

Var Cost

Life

Year

Inc. Revenues

Var Costs

Depreciation

Pretax income

Taxes

NOPAT

Add back Depr.

Initial investmet

Proceeds on disposal

Tax on disposal

Free Cash Flows

NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock