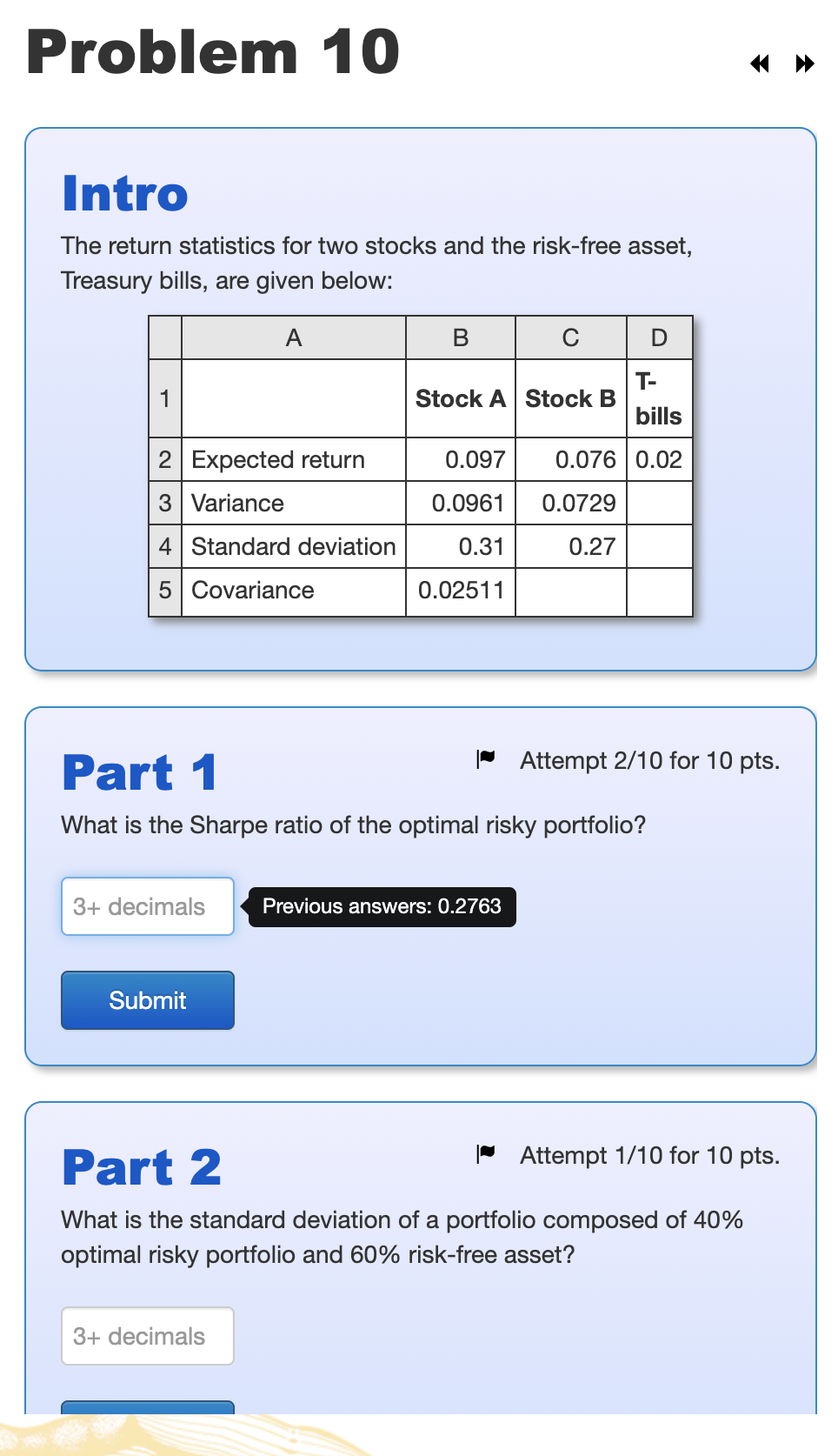

Question: Problem 10 * Intro The return statistics for two stocks and the risk-free asset, Treasury bills, are given below: A B D 1 Stock A

Problem 10 * Intro The return statistics for two stocks and the risk-free asset, Treasury bills, are given below: A B D 1 Stock A Stock B T- bills 0.097 0.076 0.02 2 Expected return 3 Variance 0.0961 0.0729 4 Standard deviation 0.31 0.27 5 Covariance 0.02511 pts. Part 1 | Attempt 2/10 for What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Previous answers: 0.2763 Submit Part 2 | Attempt 1/10 for 10 pts. What is the standard deviation of a portfolio composed of 40% optimal risky portfolio and 60% risk-free asset? 3+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts