Question: Problem 10.23 A new security is introduced and it is expected after a year to be selling for $150 per share. The current risk-neutral rate

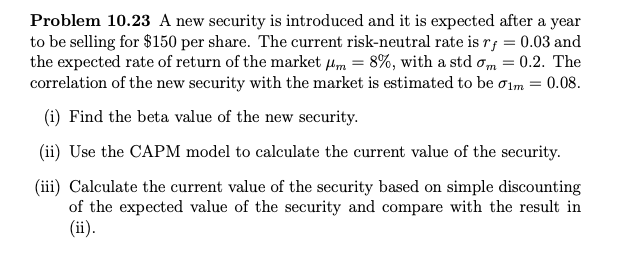

Problem 10.23 A new security is introduced and it is expected after a year to be selling for $150 per share. The current risk-neutral rate is rf=0.03 and the expected rate of return of the market m=8%, with a std m=0.2. The correlation of the new security with the market is estimated to be 1m=0.08. (i) Find the beta value of the new security. (ii) Use the CAPM model to calculate the current value of the security. (iii) Calculate the current value of the security based on simple discounting of the expected value of the security and compare with the result in (ii). Problem 10.23 A new security is introduced and it is expected after a year to be selling for $150 per share. The current risk-neutral rate is rf=0.03 and the expected rate of return of the market m=8%, with a std m=0.2. The correlation of the new security with the market is estimated to be 1m=0.08. (i) Find the beta value of the new security. (ii) Use the CAPM model to calculate the current value of the security. (iii) Calculate the current value of the security based on simple discounting of the expected value of the security and compare with the result in (ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts