Question: Problem 10-29 (Algorithmic) (LO. 3, 14) Kenisha and Shawna form the equal KS LLC, with a cash contribution of $814,000 from Kenisha and a property

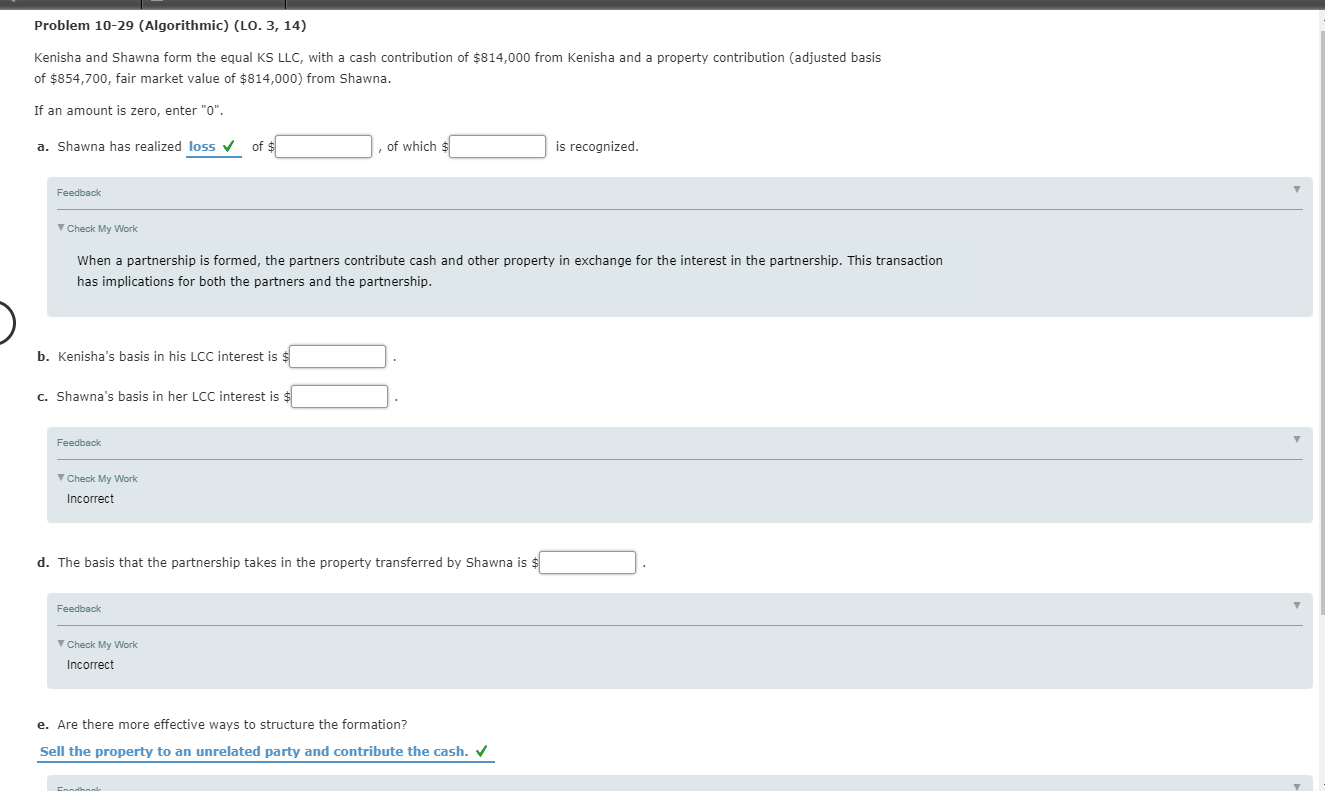

Problem 10-29 (Algorithmic) (LO. 3, 14) Kenisha and Shawna form the equal KS LLC, with a cash contribution of $814,000 from Kenisha and a property contribution (adjusted basis of $854,700, fair market value of $814,000) from Shawna. If an amount is zero, enter "0". a. Shawna has realized loss of $C , of which $ is recognized. Feedback Check My Work When a partnership is formed, the partners contribute cash and other property in exchange for the interest in the partnership. This transaction has implications for both the partners and the partnership. b. Kenisha's basis in his LCC interest is $ c. Shawna's basis in her LCC interest is $ Feedback Check My Work Incorrect d. The basis that the partnership takes in the property transferred by Shawna is $ Feedback Check My Work Incorrect e. Are there more effective ways to structure the formation? Sell the property to an unrelated party and contribute the cash.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts