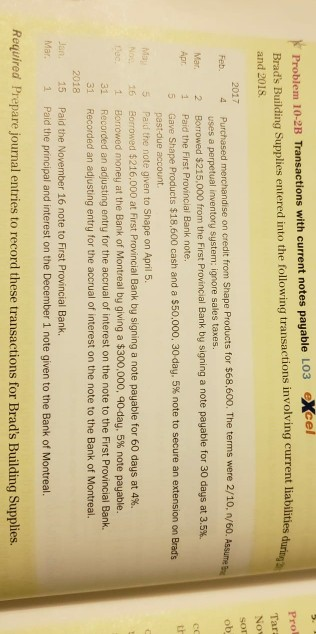

Question: Problem 10-2B Transactions with current notes payable LO3 eXcel Brad's Bui and 2018 Pro es d ilding Supplies entered into the following transactions involving current

Problem 10-2B Transactions with current notes payable LO3 eXcel Brad's Bui and 2018 Pro es d ilding Supplies entered into the following transactions involving current liabiliti 2017 4 Purchased merchandise on credit from Shape Products for $68.600. The terms were 2/10. n/60. Assumes uses a perpetual inventory system: ignore sales taxes. Mar. 2 Borrowed $215,000 from the First Provincial Bank by signing a note payable for 30 days at 3.5% Apr. 1 Paid the First Provincial Bank note. th Gave Shape Products $18,600 cash and a s 50,000, 30-day, 5% note to secure an extension on Brad's past-due account. Ma 5 Paid the note given to Shape on April 5. No. 16 Borrowed $216,000 at First Provincial Bank by signing a note payable for 60 days at 4%. Borrowed money at the Bank of Montreal by giving a $300,000, 90day, 5% note payable. Recorded an adjusting entry for the accrual of interest on the note to the First Provincial Bank. Recorded an adjusting entry for the accrual of interest on the note to the Bank of Montreal. 31 31 2018 Jan 15 Paid the November 16 note to First Provincial Bank, Mar i Paid the principal and interest on the December 1 note given to the Bank of Montreal. Required Prepare journal entries to record these transactions for Brad's Building Supplies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts