Question: Problem 1-03A a1-a3 (Part Level Submission) On June 1, 2022, Wildhorse Co. was started with an initial investment in the company of $19,750 cash. Here

|

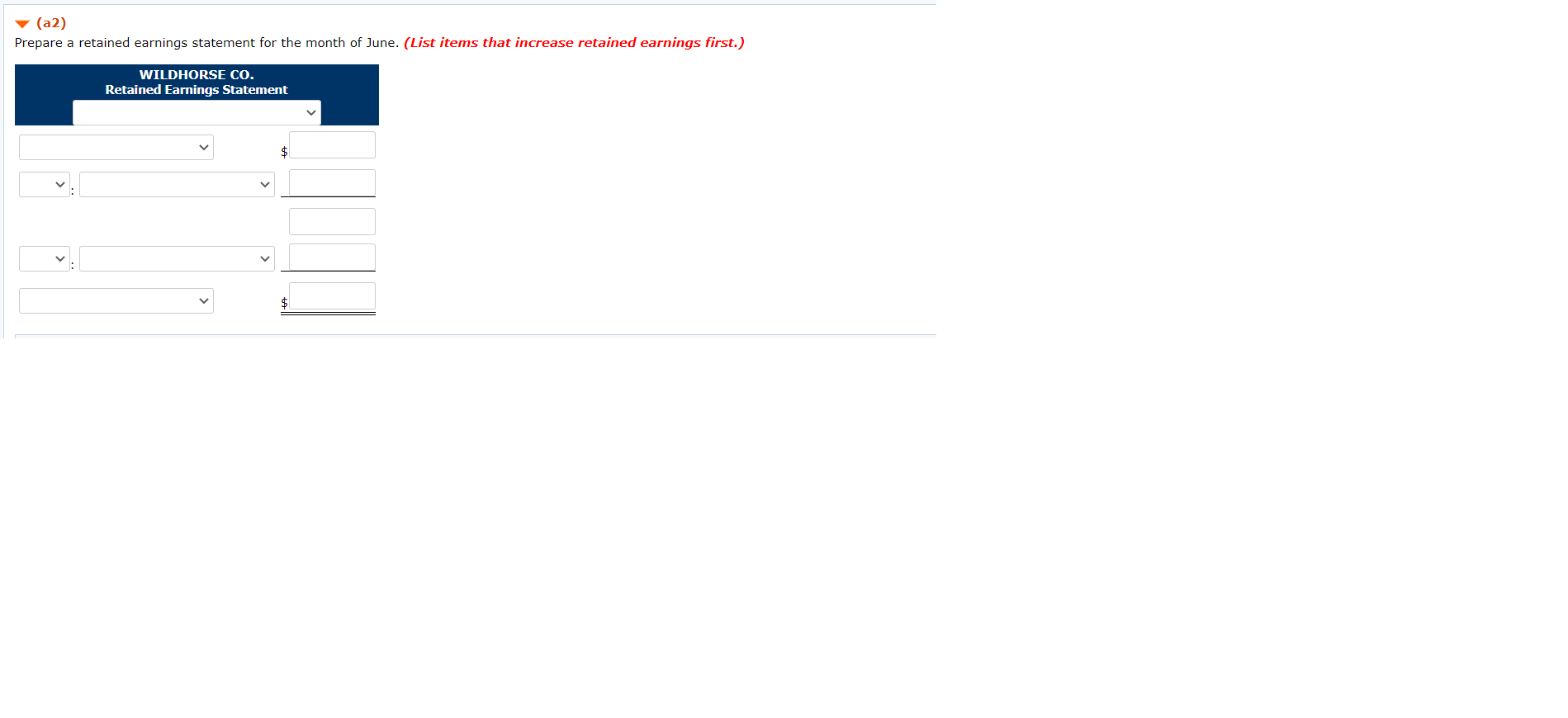

***Must follow this format..... for the month ended or for the year ended or just june 30,2022

for the first drop down options--- dividends, expenses, net income/loss, retained earnings june 1, retained earnings june 30, revenues, total expenses, or total revenues

second drop down--- add or less

third drop down ---dividends, expenses, net income/loss, retained earnings june 1, retained earnings june 30, revenues, total expenses, or total revenues

fourth drop down---- add or less

fifth drop down---- dividends, expenses, net income/loss, retained earnings june 1, retained earnings june 30, revenues, total expenses, or total revenues

sixth drop down-----dividends, expenses, net income/loss, retained earnings june 1, retained earnings june 30, revenues, total expenses, or total revenues

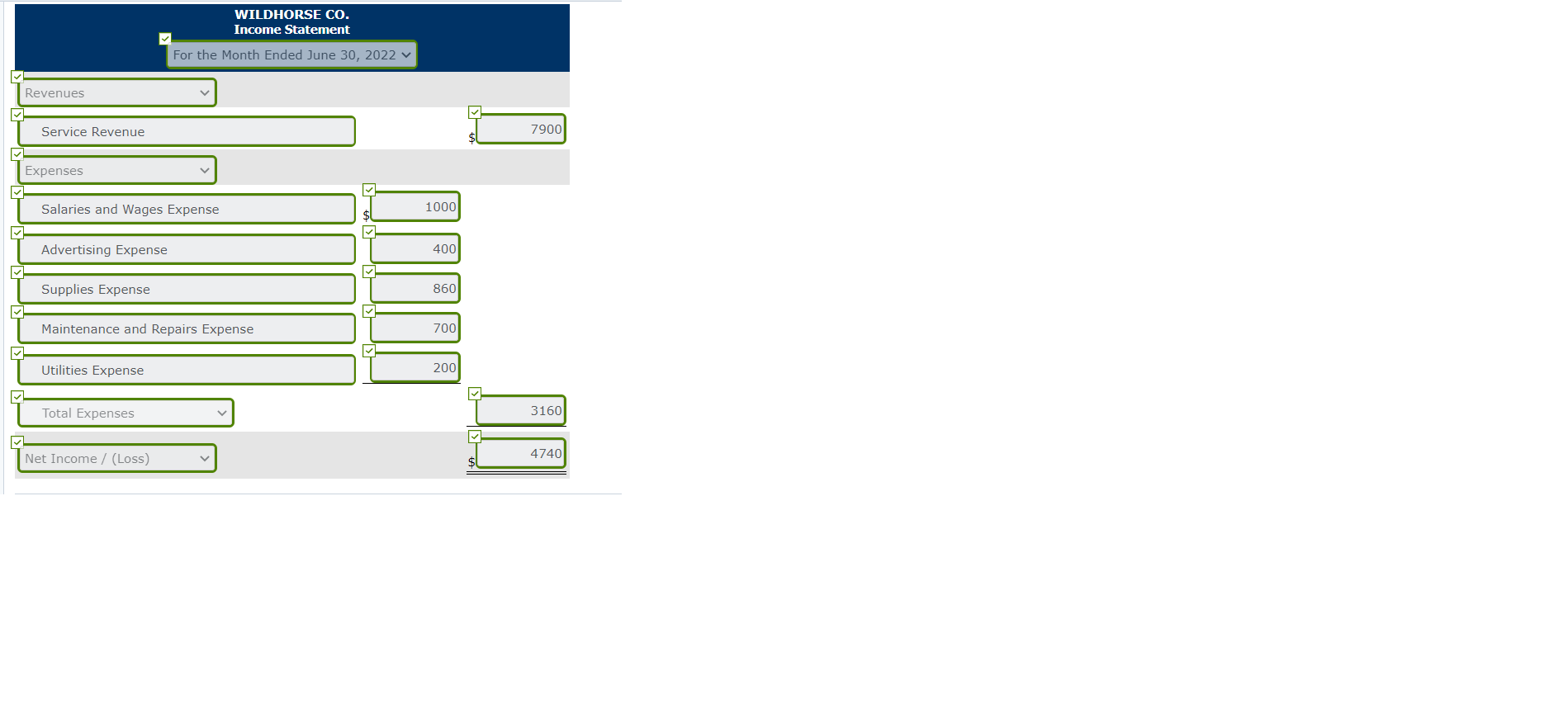

WILDHORSE CO. Income Statement For the Month Ended June 30, 2022 v Revenues Service Revenue 7900 Expenses Salaries and Wages Expense 1000 Advertising Expense 400 Supplies Expense 860 Maintenance and Repairs Expense 700 Utilities Expense 200 Total Expenses 3160 Net Income / (Loss) 4740 (a2) Prepare a retained earnings statement for the month of June. (List items that increase retained earnings first.) WILDHORSE CO. Retained Earnings Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts