Question: Problem 10-40 ( L0. 3,6,7,9,10,11) Suzy contributed assets valued at $360,000 (basis of $200,000 ) in exchange for her 40% interest in Suz-Anno. GP (a

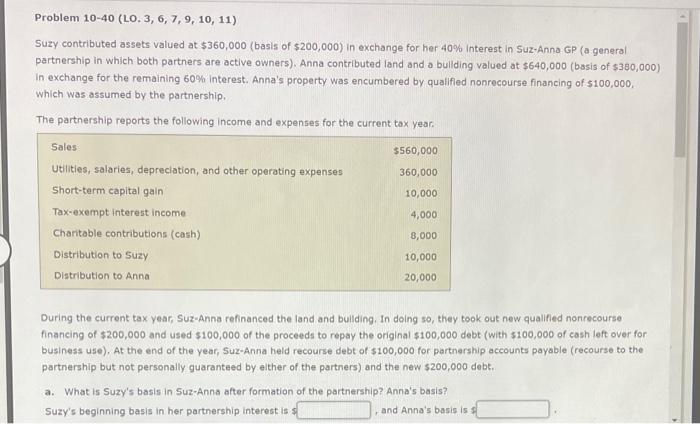

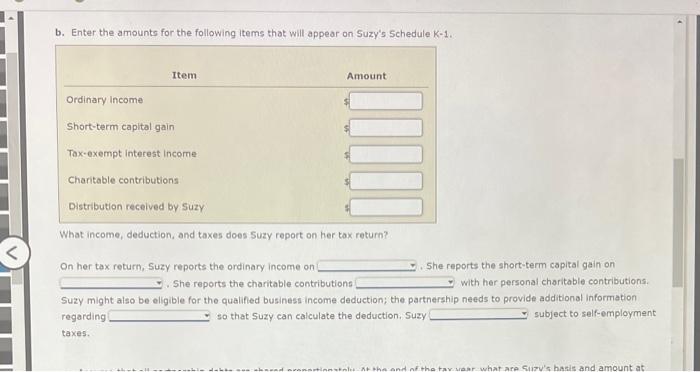

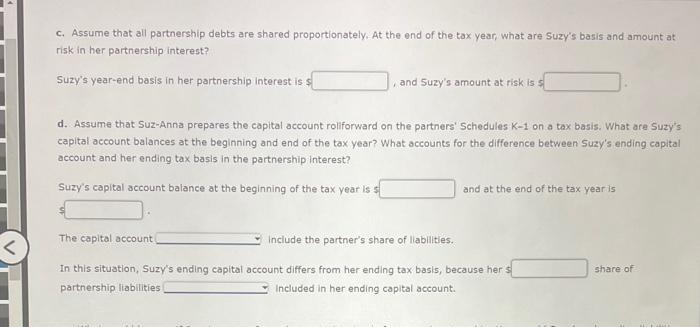

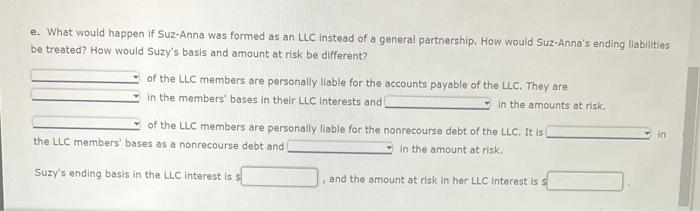

Problem 10-40 ( L0. 3,6,7,9,10,11) Suzy contributed assets valued at $360,000 (basis of $200,000 ) in exchange for her 40% interest in Suz-Anno. GP (a general partnership in which both parthers are active owners). Anna contributed land and a bullding valued at $640,000 (bssis of $380,000 ) In exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. During the current tax year, Suz-Anna refinanced the land and building. In doing so, they took out new qualified nonrecourse financing of $200,000 and used $100,000 of the proceeds to repay the original $100,000 debt (with $100,000 of cash left over for business use). At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable (recourse to the partnership but not personally guaranteed by elther of the partners) and the new $200,000 debt. a. What is Suzy's basis in Suz-Anna after formation of the partnership? Anna's basis? Suzy's beginning basis in her partnership interest is 5 , and Anna's basis is 3 b. Enter the amounts for the following items that will appear on Suzy's schedule k1. What income, deduction, and taxes does Suzy report on her tax return? On her tax return, Suzy reports the ordinary income on She reports the short-term capital gain on . She reports the charitable contributions with her personal charitable contributions. Suzy might also be eligible for the qualifled business income deduction; the partnership needs to provide additional information regarding so that Suzy can calculate the deduction, Suzy subject to self-employment taxes. c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is $ , and Suzy's amount at risk is 5 d. Assume that Suz-Anna prepares the capital account rolforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? What accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest? Suzy's capital account balance at the beginning of the tax year is 1 and at the end of the tax year is The capital account include the partner's share of llabilities. In this situation, Suzy's ending capital account differs from her ending tax basis, because her share of partnership liabilities Included in her ending capital account. e. What would happen if Suz-Anna was formed as an LLC instead of a general partnership. How would Suz-Anna's ending liabilities be treated? How would Suzy's basis and amount at risk be different? of the LLC members are personally llable for the accounts payable of the LLC. They are in the members' bases in their LLC interests and in the amounts at risk. of the LLC members are personally liable for the nonrecourse debt of the LLC. It is the LLC members' bases as a nonrecourse debt and in the amount at risk. Suzy's ending basis in the LLC interest is $ , and the amount at risk in her LLC interest is 3 Problem 10-40 ( L0. 3,6,7,9,10,11) Suzy contributed assets valued at $360,000 (basis of $200,000 ) in exchange for her 40% interest in Suz-Anno. GP (a general partnership in which both parthers are active owners). Anna contributed land and a bullding valued at $640,000 (bssis of $380,000 ) In exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. During the current tax year, Suz-Anna refinanced the land and building. In doing so, they took out new qualified nonrecourse financing of $200,000 and used $100,000 of the proceeds to repay the original $100,000 debt (with $100,000 of cash left over for business use). At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable (recourse to the partnership but not personally guaranteed by elther of the partners) and the new $200,000 debt. a. What is Suzy's basis in Suz-Anna after formation of the partnership? Anna's basis? Suzy's beginning basis in her partnership interest is 5 , and Anna's basis is 3 b. Enter the amounts for the following items that will appear on Suzy's schedule k1. What income, deduction, and taxes does Suzy report on her tax return? On her tax return, Suzy reports the ordinary income on She reports the short-term capital gain on . She reports the charitable contributions with her personal charitable contributions. Suzy might also be eligible for the qualifled business income deduction; the partnership needs to provide additional information regarding so that Suzy can calculate the deduction, Suzy subject to self-employment taxes. c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is $ , and Suzy's amount at risk is 5 d. Assume that Suz-Anna prepares the capital account rolforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? What accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest? Suzy's capital account balance at the beginning of the tax year is 1 and at the end of the tax year is The capital account include the partner's share of llabilities. In this situation, Suzy's ending capital account differs from her ending tax basis, because her share of partnership liabilities Included in her ending capital account. e. What would happen if Suz-Anna was formed as an LLC instead of a general partnership. How would Suz-Anna's ending liabilities be treated? How would Suzy's basis and amount at risk be different? of the LLC members are personally llable for the accounts payable of the LLC. They are in the members' bases in their LLC interests and in the amounts at risk. of the LLC members are personally liable for the nonrecourse debt of the LLC. It is the LLC members' bases as a nonrecourse debt and in the amount at risk. Suzy's ending basis in the LLC interest is $ , and the amount at risk in her LLC interest is 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts