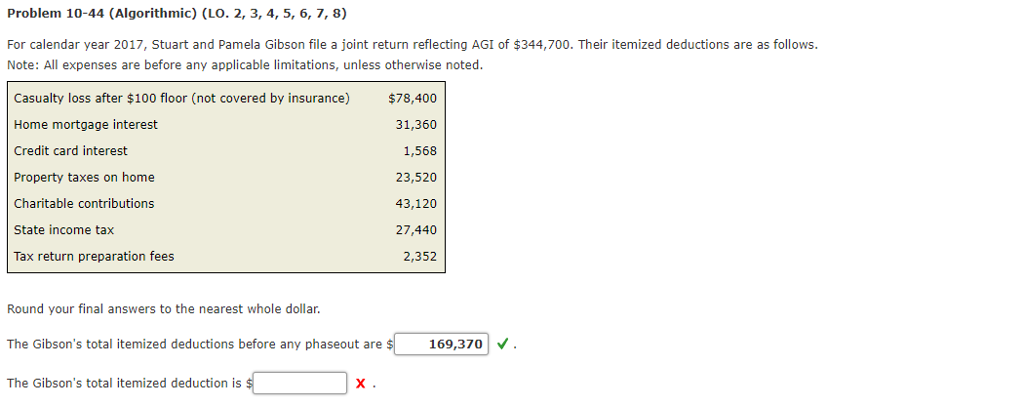

Question: Problem 10-44 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7, 8) For calendar year 2017, Stuart and Pamela Gibson file a joint return reflecting AGI

Problem 10-44 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7, 8) For calendar year 2017, Stuart and Pamela Gibson file a joint return reflecting AGI of $344,700. Their itemized deductions are as follows. Note: All expenses are before any applicable limitations, unless otherwise noted Casualty loss after $100 floor (not covered by insurance) Home mortgage interest Credit card interest Property taxes on home Charitable contributions State income tax Tax return preparation fees $78,400 31,360 1,568 23,520 43,120 27,440 2,352 Round your final answers to the nearest whole dollar The Gibson's total itemized deduction is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts