Question: Problem 10-64 (Static) Activity-Based Reporting: Service Organization (LO 10-3, 4) Lozier Catering and Events (LCE) offers a variety of services from small gatherings to

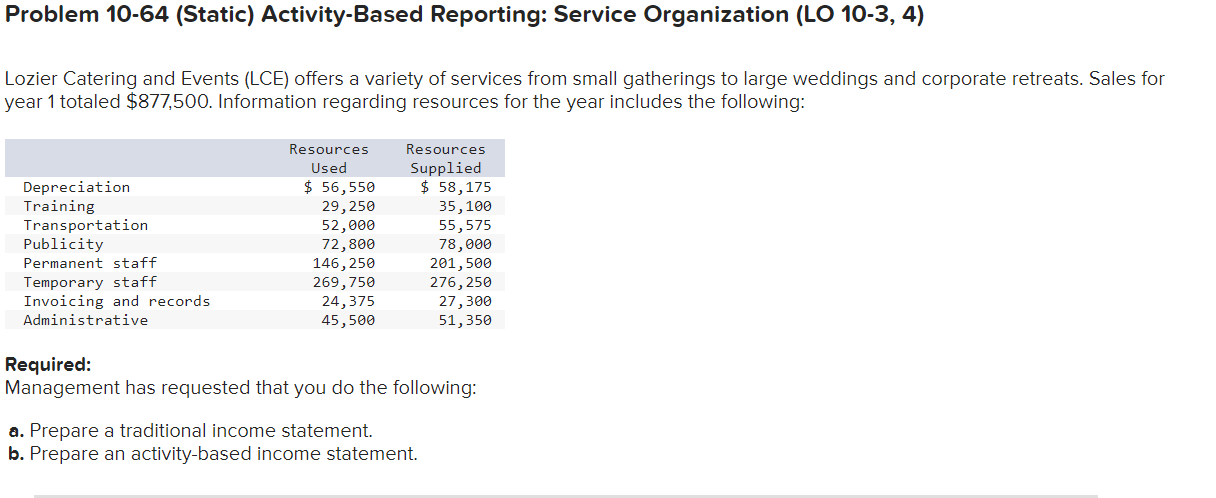

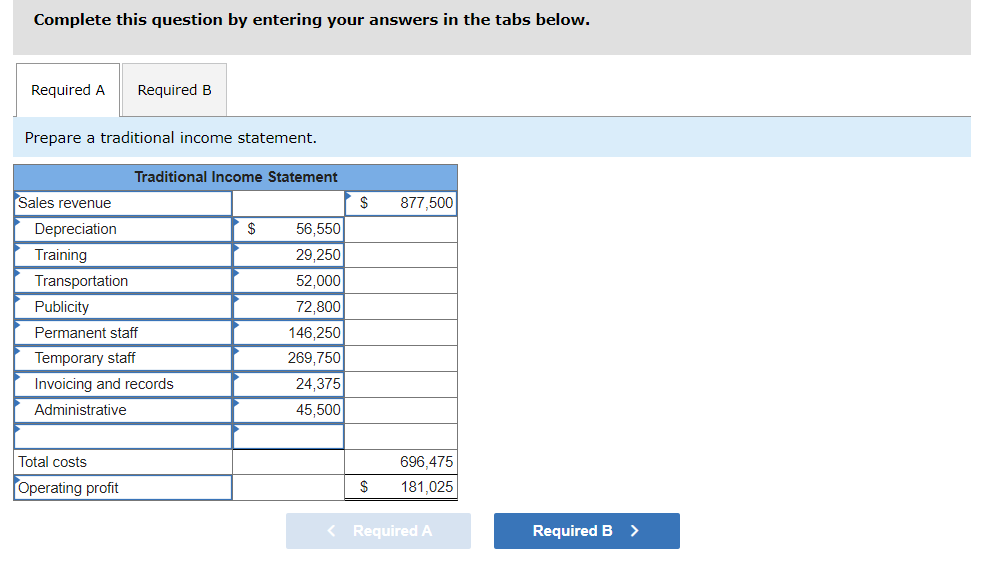

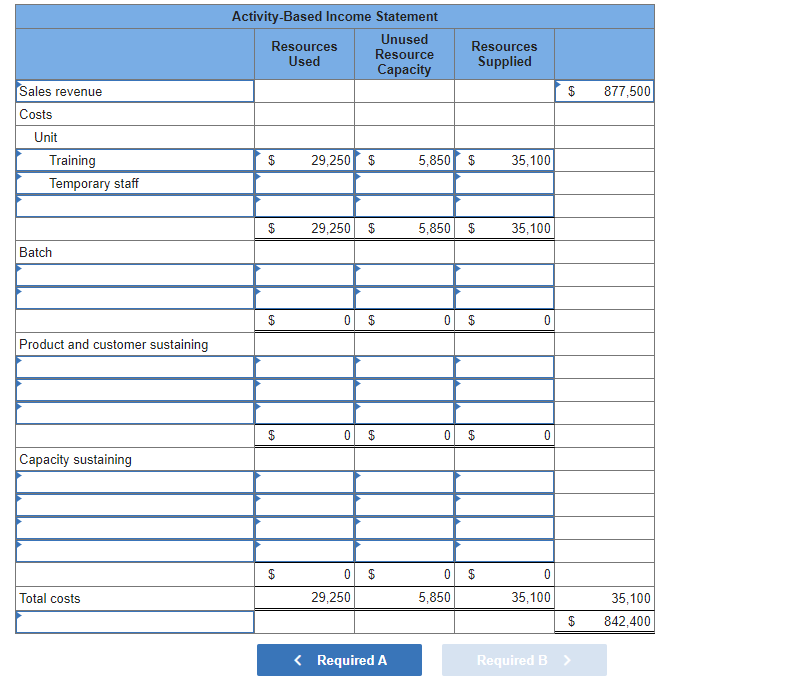

Problem 10-64 (Static) Activity-Based Reporting: Service Organization (LO 10-3, 4) Lozier Catering and Events (LCE) offers a variety of services from small gatherings to large weddings and corporate retreats. Sales for year 1 totaled $877,500. Information regarding resources for the year includes the following: Resources Used Resources Supplied Depreciation $ 56,550 $ 58,175 Training Publicity 29,250 35,100 Transportation 52,000 55,575 72,800 78,000 Permanent staff 146,250 201,500 Temporary staff 269,750 276,250 Invoicing and records 24,375 27,300 Administrative 45,500 51,350 Required: Management has requested that you do the following: a. Prepare a traditional income statement. b. Prepare an activity-based income statement. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a traditional income statement. Traditional Income Statement Sales revenue $ 877,500 Depreciation $ 56,550 Training 29,250 Transportation 52,000 Publicity 72,800 Permanent staff 146,250 Temporary staff 269,750 Invoicing and records 24,375 Administrative 45,500 Total costs Operating profit 696,475 $ 181,025 < Required A Required B > Sales revenue Costs Activity-Based Income Statement Resources Used Unused Resource Capacity Resources Supplied $ 877,500 Unit Training $ 29,250 $ 5,850 $ 35,100 Temporary staff Batch 29,250 $ 5,850 35,100 $ 0 $ 0 $ 0 Product and customer sustaining Capacity sustaining 0 0 $ 0 $ 0 $ 0 Total costs 29,250 5,850 35,100 35,100 $ 842,400 < Required A Required B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts