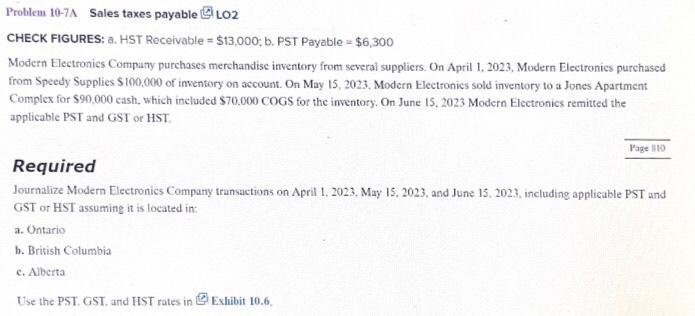

Question: Problem 10-7A Sales taxes payable &ULO2 CHECK FIGURES: a. HST Receivable =$13,000;b. PST Payable =$6,300 Modern Electronics Compary purchases merchandise inventory from severai suppliers. On

Problem 10-7A Sales taxes payable \&ULO2 CHECK FIGURES: a. HST Receivable =$13,000;b. PST Payable =$6,300 Modern Electronics Compary purchases merchandise inventory from severai suppliers. On April 1, 2023, Modern Electronies purchased from Speedy Supplies $100,000 of inventory on account. On May 15, 2023, Modern Electronics sold inventory to a Jones Apartment Complex for $90,000 cash, which included $70.000 COGS for the inventory. On June 15, 2023 Modern Electronics remitted the applicable PST and GST or HST. Required Journalize Modern Electronics Company transactions on April 1, 2023, May 15, 2023, and June 15, 2023, including applicable PST and GST or HST assuming it is located in: a. Ontario b. British Columbia c. Alberta Use the PST. GST, and HST rates in E Exhibit 10.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts