Question: Problem 10-7B Sales taxes payable [C: LO2 CHECK FIGURES: a. HST Receivable =$6,000; b. PST Payable =$800 Appleton Electronics Company purchases merchandise inventory from several

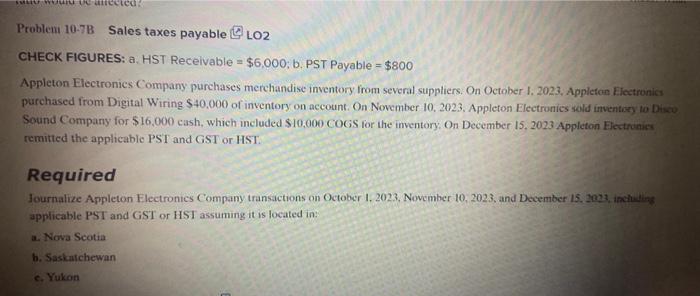

Problem 10-7B Sales taxes payable [C: LO2 CHECK FIGURES: a. HST Receivable =$6,000; b. PST Payable =$800 Appleton Electronics Company purchases merchandise inventory from several suppliers. On October 1, 2023, Appleten Eiectronics purchased from Digital Wiring $40,000 of inventory on account. On Nowember 10, 2023. Appleton Electronics sold inventuey to Dhave Sound Company for $16,000 cash, which included $10,000 COGS for the imventory. On December 15, 2023 Appleton Eectranies remitted the applicable PSI and GST or HST. Required Journalize Appleton Electronics Company transactions on October 1, 2023, November 10, 2023, and December 15. 2023, inchisines applicable PSI and GST or HSI assuming it is located in: a. Nova Scotia b. Saskatchewan c. Yukon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts