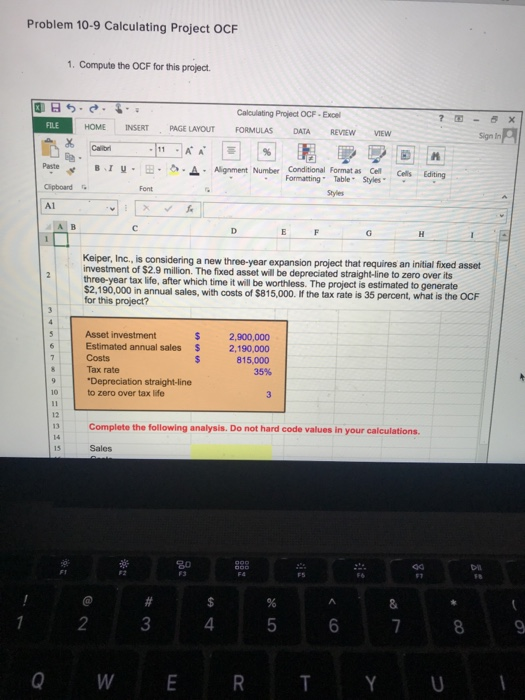

Question: Problem 10-9 Calculating Project OCF 1. Compute the OCF for this project Calculating Project OCF-Excel OME INSERT PAGE LAYOUT FORMULAS DATA REVEw vew , Sign

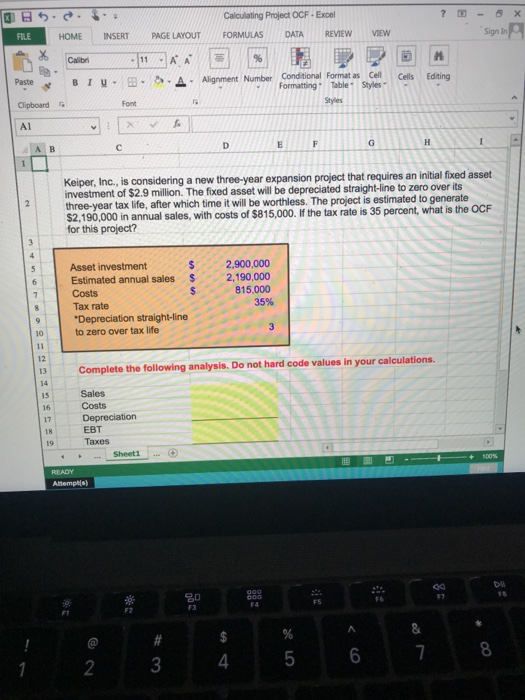

Problem 10-9 Calculating Project OCF 1. Compute the OCF for this project Calculating Project OCF-Excel OME INSERT PAGE LAYOUT FORMULAS DATA REVEw vew , Sign In B . 1 u . | e),-. Algnment Number Conditional Format as Cel Formatting Table Styles Cipboard S Font A1 Keiper, Inc., jis considering a new three-year expan investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its hree-year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. If the tax rate is 35 percent, what is the OCF for this project? sion project that requires an initial fixed asset Asset investment Estimated annual sales Costs Tax rate 2,900,000 $ 2,190,000 815,000 35% Depreciation straight-line to zero over tax life 10 13 Complete the following analysis. Do not hard code values in your calculations 2 4 Q W ERTY U Calculating Project OCF-Excel HOME INSERT PAGE LAYOUTFORMULAS DATAREVIEW VIEW 1| Sign In \Calibri 11.IA'a" |% | 8IU A Aligment Number Condtional format as Cel Font Clipboard Al Keiper, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year $2,190,000 in annual sales, with costs of $815,000. If the tax rate is 35 percent, what is the OCF for this project tax life, after which time it will be worthless. The project is estimated to generate 2,900,000 Asset investment 6 Estimated annual sales Costs Tax rate Depreciation straight-line to zero over tax life 2,190,000 815,000 35% 10 13Complete the following analysis. Do not hard code values in your calculations. s Sales 16 Costs EBT Taxes 18 19 Attempets F3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts