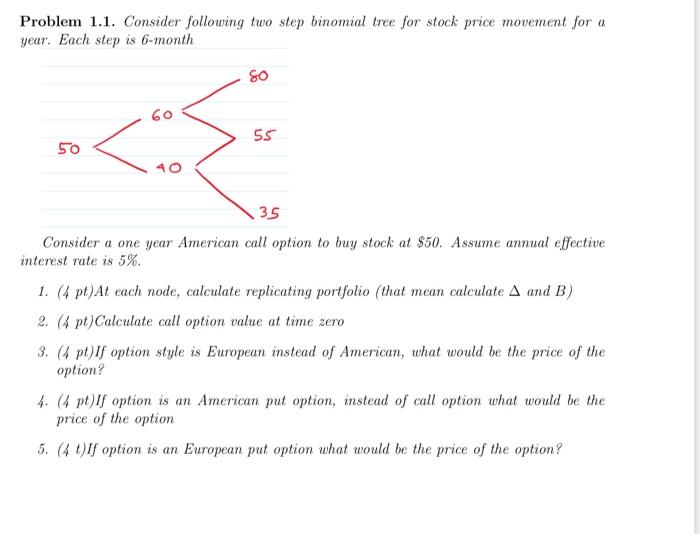

Question: Problem 1.1. Consider following two step binomial tree for stock price movement for a year. Each step is 6-month 60 55 35 Consider a one

Problem 1.1. Consider following two step binomial tree for stock price movement for a year. Each step is 6-month 60 55 35 Consider a one year American call option to buy stock at $50. Assume annual effective interest rate is 5%. 1. (4 pt)At each node, calculate replicating portfolio (that mean calculate A and B) 2. (4 pt)Calculate call option value at time zero 3. (4 pt)If option style is European instead of American, what would be the price of the option? 4. (4 pt)If option is an American put option, instead of call option what would be the price of the option 5. (4)If option is an European put option what would be the price of the option? Problem 1.1. Consider following two step binomial tree for stock price movement for a year. Each step is 6-month 60 55 35 Consider a one year American call option to buy stock at $50. Assume annual effective interest rate is 5%. 1. (4 pt)At each node, calculate replicating portfolio (that mean calculate A and B) 2. (4 pt)Calculate call option value at time zero 3. (4 pt)If option style is European instead of American, what would be the price of the option? 4. (4 pt)If option is an American put option, instead of call option what would be the price of the option 5. (4)If option is an European put option what would be the price of the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts