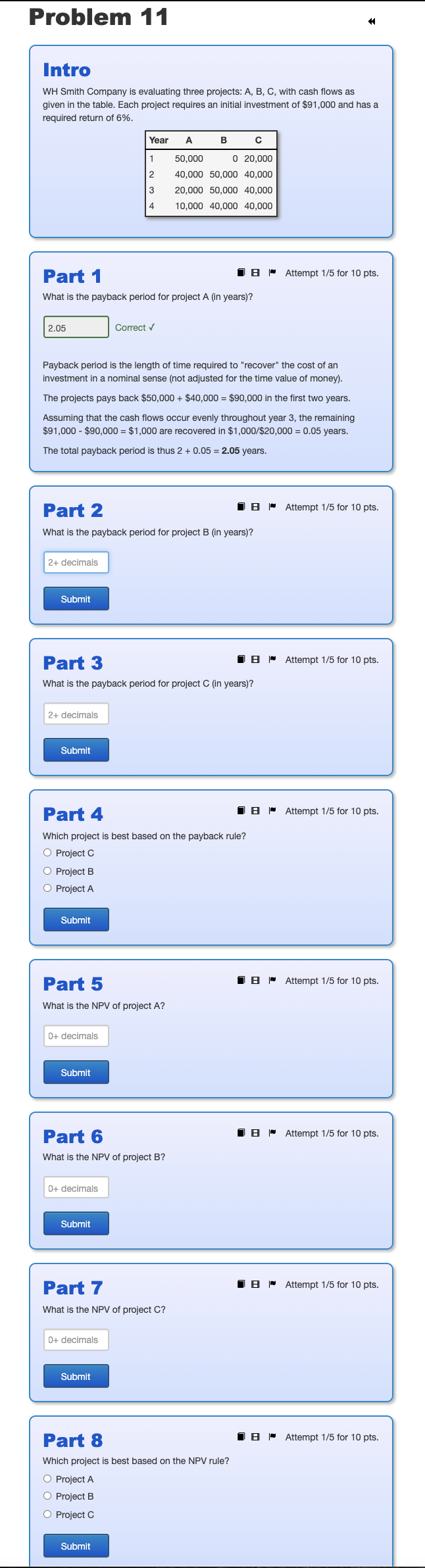

Question: Problem 11 Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an

Problem 11 Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $91,000 and has a required return of 6%. Year A B 1 2 3 4 50,000 0 20,000 40,000 50,000 40,000 20,000 50,000 40,000 10,000 40,000 40,000 Part 1 18 Attempt 1/5 for 10 pts. What is the payback period for project A (in years)? 2.05 Correct Payback period is the length of time required to "recover" the cost of an investment in a nominal sense (not adjusted for the time value of money). The projects pays back $50,000+ $40,000 = $90,000 in the first two years. Assuming that the cash flows occur evenly throughout year 3, the remaining $91,000 - $90,000 = $1,000 are recovered in $1,000/$20,000 = 0.05 years. The total payback period is thus 2 + 0.05 = 2.05 years. - Attempt 1/5 for 10 pts. Part 2 18 What is the payback period for project B (in years)? 2+ decimals Submit Part 3 Is Attempt 1/5 for 10 pts. What is the payback period for project C (in years)? 2+ decimals Submit Part 4 18 Attempt 1/5 for 10 pts. Which project is best based on the payback rule? O Project O Project B O Project A Submit Part 5 Io Attempt 1/5 for 10 pts. What is the NPV of project A? 0+ decimals Submit 18 Attempt 1/5 for 10 pts. Part 6 What is the NPV of project B? 0+ decimals Submit Part 7 IB | Attempt 1/5 for 10 pts. What is the NPV of project C? 0+ decimals Submit Is Attempt 1/5 for 10 pts. Part 8 Which project is best based on the NPV rule? O Project A O Project B O Project Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts