Question: Problem 11-02A a-c (Part Level Submission) Marigold Corp. had the following stockholders' equity accounts on January 1, 2020: Common Stock ($5 par) $540,000, Paid-in Capital

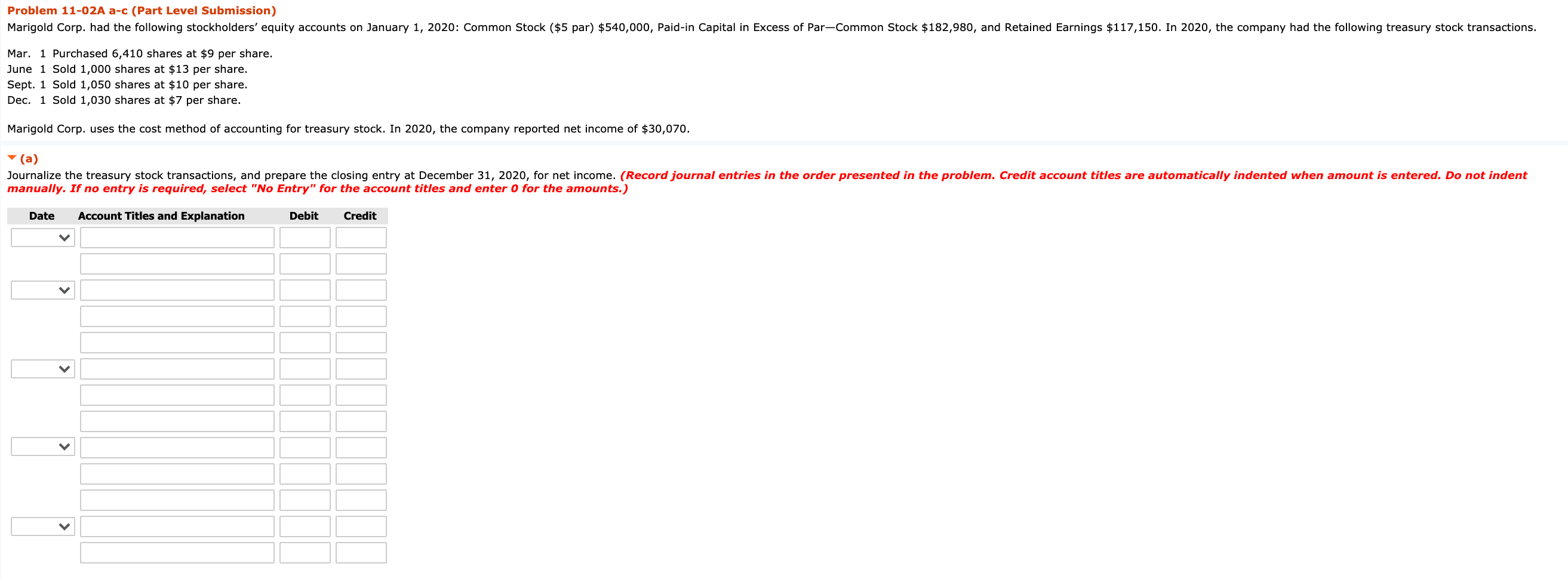

Problem 11-02A a-c (Part Level Submission) Marigold Corp. had the following stockholders' equity accounts on January 1, 2020: Common Stock ($5 par) $540,000, Paid-in Capital in Excess of Par-Common Stock $182,980, and Retained Earnings $117,150. In 2020, the company had the following treasury stock transactions. Mar. 1 Purchased 6,410 shares at $9 per share. June 1 Sold 1,000 shares at $13 per share. Sept. 1 Sold 1,050 shares at $10 per share. Dec. 1 Sold 1,030 shares at $7 per share. Marigold Corp. uses the cost method of accounting for treasury stock. In 2020, the company reported net income of $30,070. (a) Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2020, for net income. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts