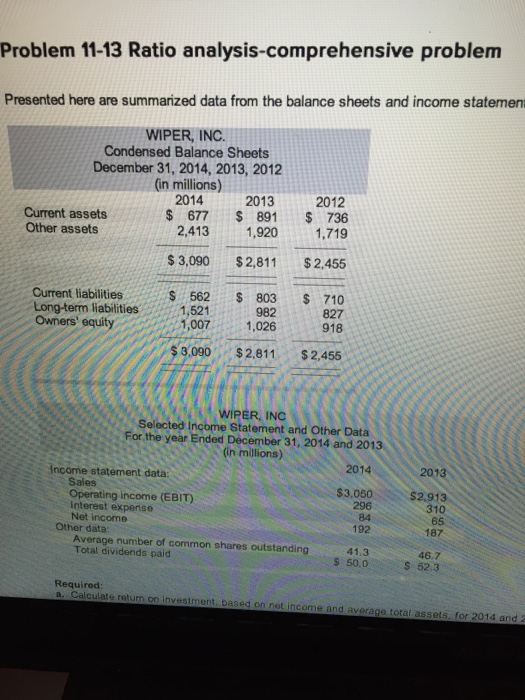

Question: Problem 11-13 Ratio analysis-comprehensive problenm Presented here are summarized data from the balance sheets and income statement WIPER, INC. Condensed Balance Sheets December 31, 2014,

Problem 11-13 Ratio analysis-comprehensive problenm Presented here are summarized data from the balance sheets and income statement WIPER, INC. Condensed Balance Sheets December 31, 2014, 2013, 2012 in milions) 2014 2013 2012 Current assets Other assets 677 $ 891 736 2,413 1,920 1,719 3,090 $2,811 $2,455 803 $ 710 827 918 $ 562 Current liabilities Long-term liabilities Owners equity 982 1,521 1,0071,026 $3,090$2,811$2,455 3.090 $2.811 $2,455 WIPER, INC Selected Income Statement and Other Data For the year Ended December 31, 2014 and 2013 (in millions) 2014 . : 2013 Income statement data Sales Operating income (EBIT) Interest expense Net income $3,050$2,913 310 65 187 296 84 192 Other data Average number of common shares outstanding Total dividends paid 41.3 46.7 s 50.0S52.3 Required a. Calculate returm on investment. based on net income e and average totaf assets, for 2014 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts