Question: Problem 1-11A Computing and interpreting return on assets LO A2 Coca-Cola and PepsiCo both produce and market beverages that are direct competitors. Key financial figures

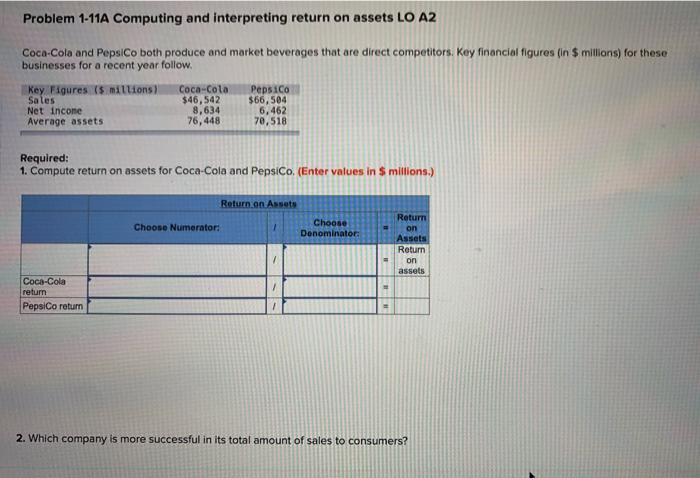

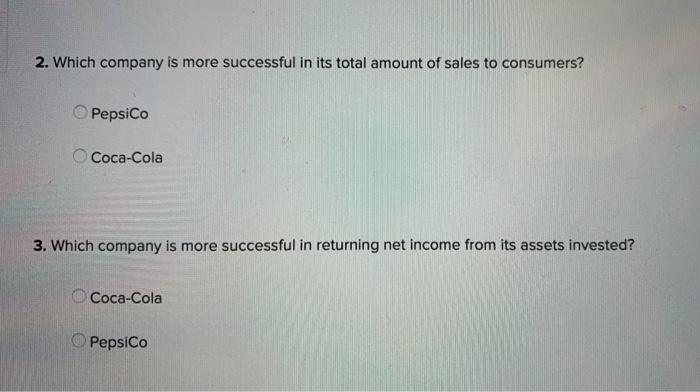

Problem 1-11A Computing and interpreting return on assets LO A2 Coca-Cola and PepsiCo both produce and market beverages that are direct competitors. Key financial figures in $ millions) for these businesses for a recent year follow. Key Figures (5 millions Coca-Cola PepsiCo Sales $46,542 $66,504 Net Income 8,634 6,462 Average assets 76,448 70,518 Required: 1. Compute return on assets for Coca-Cola and PepsiCo. (Enter values in 5 millions.) Return on Assets Choose Numerator: Choose Denominator Return on Assets Return on assets Coca-Cola return PepsiCo return 2. Which company is more successful in its total amount of sales to consumers? 2. Which company is more successful in its total amount of sales to consumers? PepsiCo Coca-Cola 3. Which company is more successful in returning net income from its assets invested? Coca-Cola PepsiCo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts