Question: Problem 11-27 (Algorithmic) (LO. 3, 4) At the beginning of the tax year, Melodie's basis in the MIP LLC was $94,000, including her $61,100 share

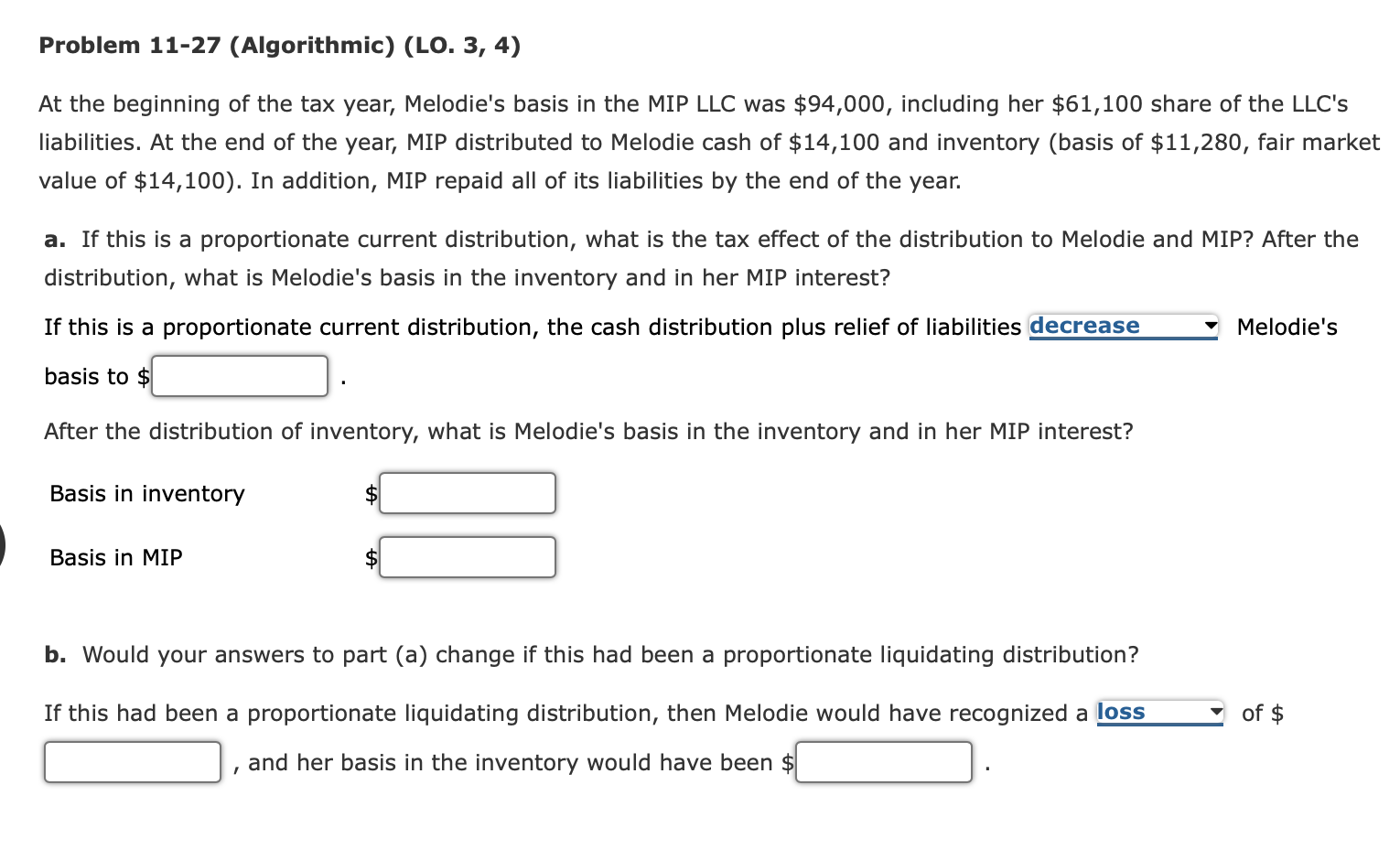

Problem 11-27 (Algorithmic) (LO. 3, 4) At the beginning of the tax year, Melodie's basis in the MIP LLC was $94,000, including her $61,100 share of the LLC's liabilities. At the end of the year, MIP distributed to Melodie cash of $14,100 and inventory (basis of $11,280, fair market value of $14,100). In addition, MIP repaid all of its liabilities by the end of the year. a. If this is a proportionate current distribution, what is the tax effect of the distribution to Melodie and MIP? After the distribution, what is Melodie's basis in the inventory and in her MIP interest? If this is a proportionate current distribution, the cash distribution plus relief of liabilities decrease Melodie's basis to $ After the distribution of inventory, what is Melodie's basis in the inventory and in her MIP interest? Basis in inventory Basis in MIP b. Would your answers to part (a) change if this had been a proportionate liquidating distribution? If this had been a proportionate liquidating distribution, then Melodie would have recognized a loss of $ 1 and her basis in the inventory would have been $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts