Question: Problem 12 You have until 11:36 PM to complete this assignment. Intro The current price of a non-dividend-paying stock is $88.59 and the annual standard

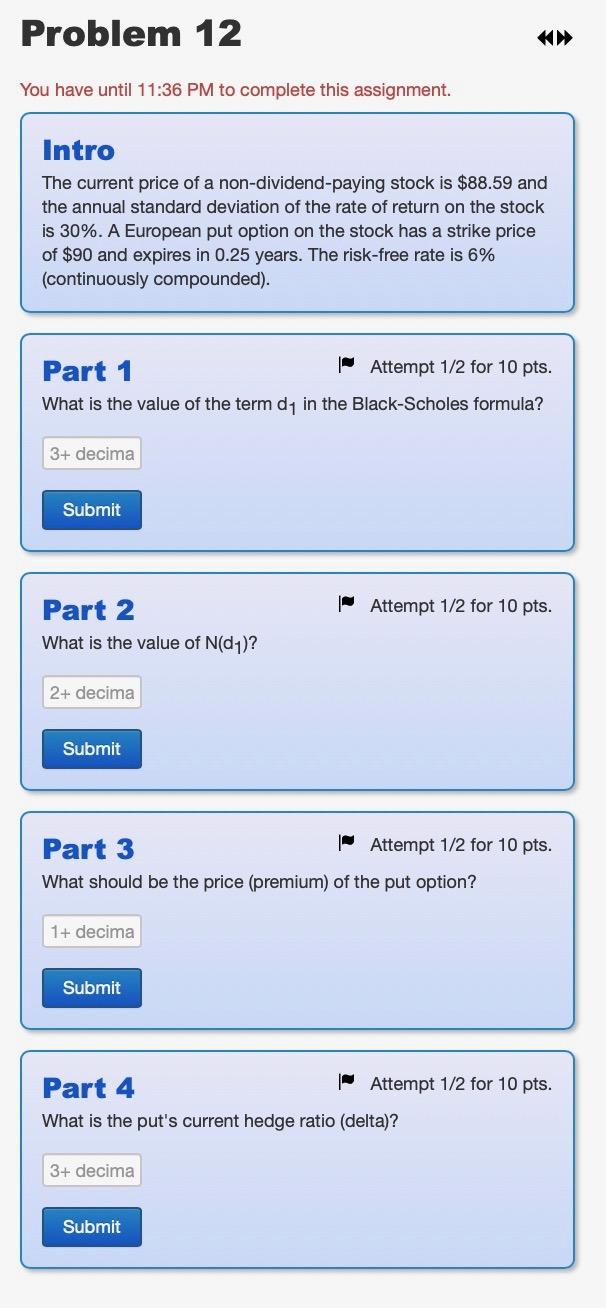

Problem 12 You have until 11:36 PM to complete this assignment. Intro The current price of a non-dividend-paying stock is $88.59 and the annual standard deviation of the rate of return on the stock is 30%. A European put option on the stock has a strike price a of $90 and expires in 0.25 years. The risk-free rate is 6% (continuously compounded). Part 1 Attempt 1/2 for 10 pts. What is the value of the term dy in the Black-Scholes formula? 3+ decima Submit " Attempt 1/2 for 10 pts. Part 2 What is the value of N(d)? 2+ decima Submit Part 3 Attempt 1/2 for 10 pts. What should be the price (premium) of the put option? 1+ decima Submit Part 4 Attempt 1/2 for 10 pts. What is the put's current hedge ratio (delta)? 3+ decima Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts