Question: Problem 12.19 (Replacement Analysis) Question 7 of 11 Check My Work (1 remaining) eBook The Darlington Equipment Company purchased a machine 5 years ago,

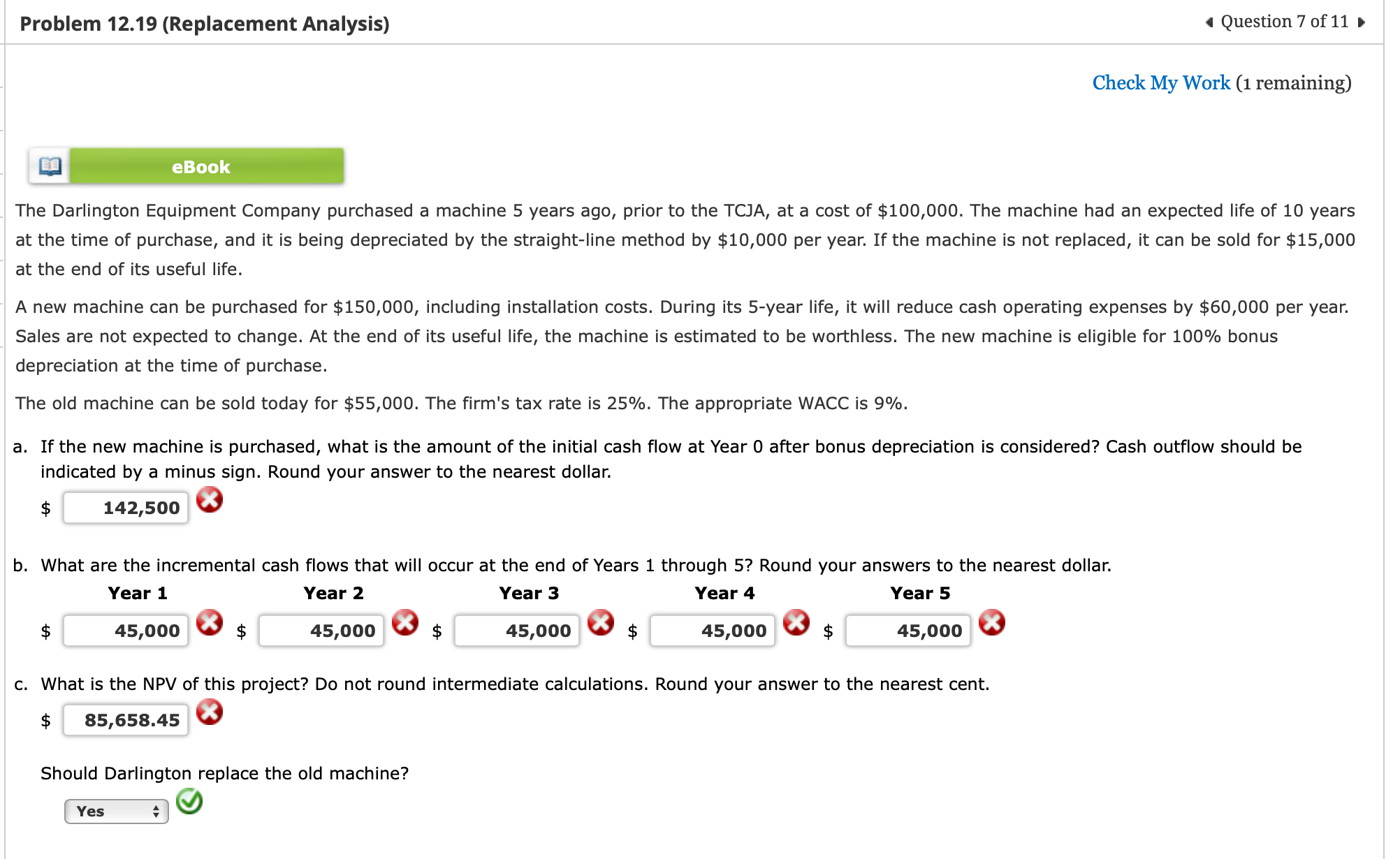

Problem 12.19 (Replacement Analysis) Question 7 of 11 Check My Work (1 remaining) eBook The Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $100,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $10,000 per year. If the machine is not replaced, it can be sold for $15,000 at the end of its useful life. A new machine can be purchased for $150,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $60,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $55,000. The firm's tax rate is 25%. The appropriate WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to the nearest dollar. $ 142,500 b. What are the incremental cash flows that will occur at the end of Years 1 through 5? Round your answers to the nearest dollar. Year 1 45,000 Year 2 45,000 Year 3 45,000 Year 4 45,000 Year 5 45,000 c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest cent. $ 85,658.45 Should Darlington replace the old machine? Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts