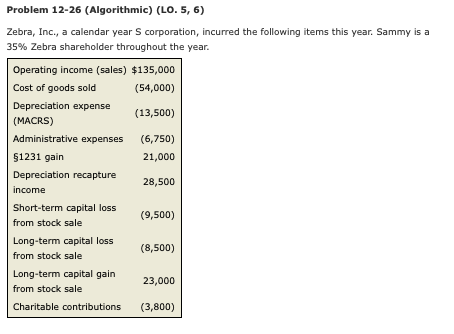

Question: Problem 12-26 (Algorithmic) (LO. 5, 6) Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 35% Zebra shareholder

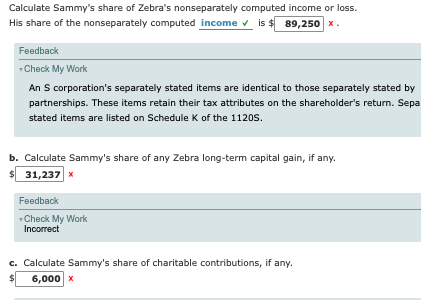

Problem 12-26 (Algorithmic) (LO. 5, 6) Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 35% Zebra shareholder throughout the year. Operating income (sales) $135,000 Cost of goods sold (54,000) Depreciation expense (13,500) (MACRS) Administrative expenses (6,750) $1231 gain 21,000 Depreciation recapture 28,500 income Short-term capital loss (9,500) from stock sale Long-term capital loss (8,500) from stock sale Long-term capital gain 23,000 from stock sale Charitable contributions (3,800) Calculate Sammy's share of Zebra's nonseparately computed income or loss. His share of the nonseparately computed income is $ 89,250 X. Feedback Check My Work An Scorporation's separately stated items are identical to those separately stated by partnerships. These items retain their tax attributes on the shareholder's return. Sepa stated items are listed on Schedule K of the 1120s. b. Calculate Sammy's share of any Zebra long-term capital gain, if any. $ 31,237 Feedback Check My Work Incorrect c. Calculate Sammy's share of charitable contributions, if any. $ 6,000 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts